By Dani Burger

(Bloomberg) --Investors are getting blasé with their choices of exchange-traded funds, according to the lead international body for securities regulation.

Paul Andrews, secretary general of the International Organization of Securities Commissions, said that ETF buyers aren’t looking closely enough at their holdings and instead are relying on diversification to keep them safe. It’s similar to the mistake investors made in 2008 when they failed to investigate risky mortgage-backed securities, he said.

“We started to look too fondly at diversification over due diligence,” Andrews said at a Central Bank of Ireland conference in Dublin on Wednesday. During the financial crisis “we essentially outsourced due diligence for credit ratings. They saw a credit rating that was triple A and invested. I don’t want us to fall into the same trap with ETFs.”

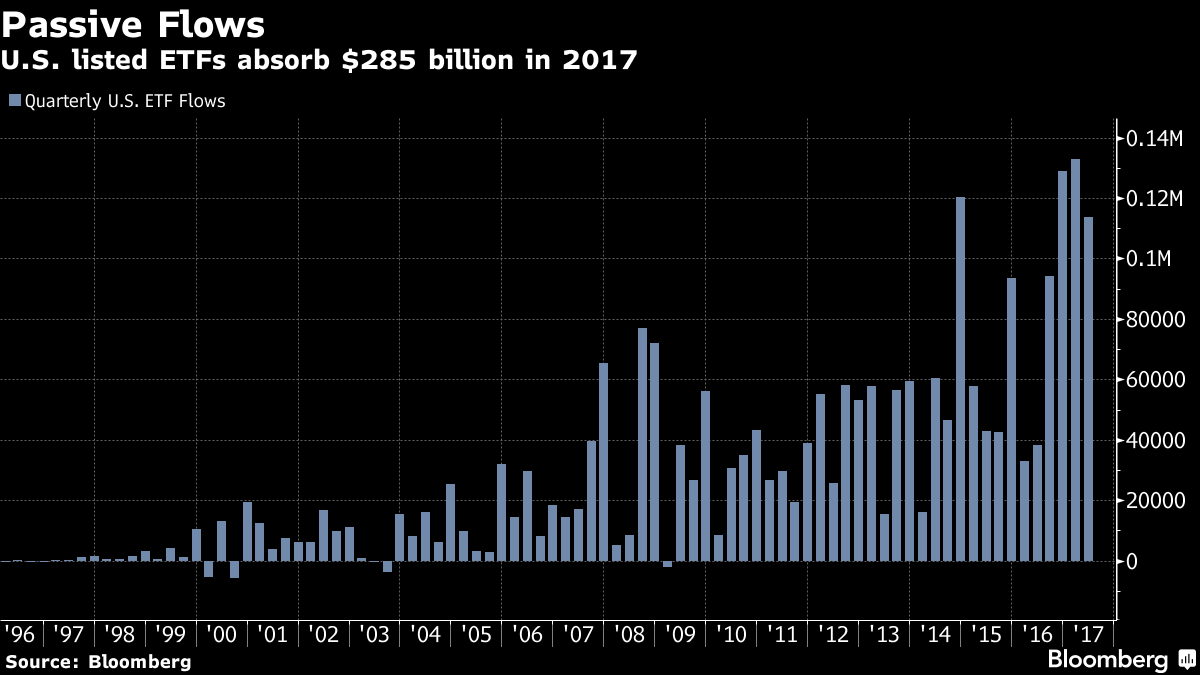

In the past year alone ETFs have attracted $547 billion in inflows, sending industry assets to a record $4.9 trillion, according to data compiled by Bloomberg. Some analysts have voiced concerns that the flow into passive funds is creating lockstep moves between shares, distorting the market.

According to Andrews, those fears outweigh actual understanding of the issue. Still, there are plenty of concerns about how ETFs will hold up in changing market environments, he said.

“Are we ready for price and liquidity shocks, is the passive world ready for that?” Andrews said. “I don’t know what form it’s going to take, but something is coming.”

Central bank officials also voiced concerns about potential dangers to investors, especially as ETF providers create more complex products.

“Everybody gets somebody else to do their due diligence and checking for them before they invest,” said Martin Moloney, a risk and policy advisor at the Central Bank of Ireland. “This means you’ve got a risk in the market of misalignment with the end investor, their liquidity needs or their investment needs. ”

To contact the reporter on this story: Dani Burger in London at [email protected] To contact the editors responsible for this story: Samuel Potter at [email protected] Cormac Mullen, Todd White