By Lisa Abramowicz

(Bloomberg Gadfly) --Crispin Odey had an impressively terrible year.

The billionaire's main hedge fund lost almost half its value in 2016, posting its worst annual loss since it started trading in 1992, according to a Bloomberg News article by Nishant Kumar. This hasn't escaped the notice of investors, who are fleeing. The Odey European Inc.'s assets under management plunged by 60 percent in the first nine months of 2016, ending September with 422 million euros.

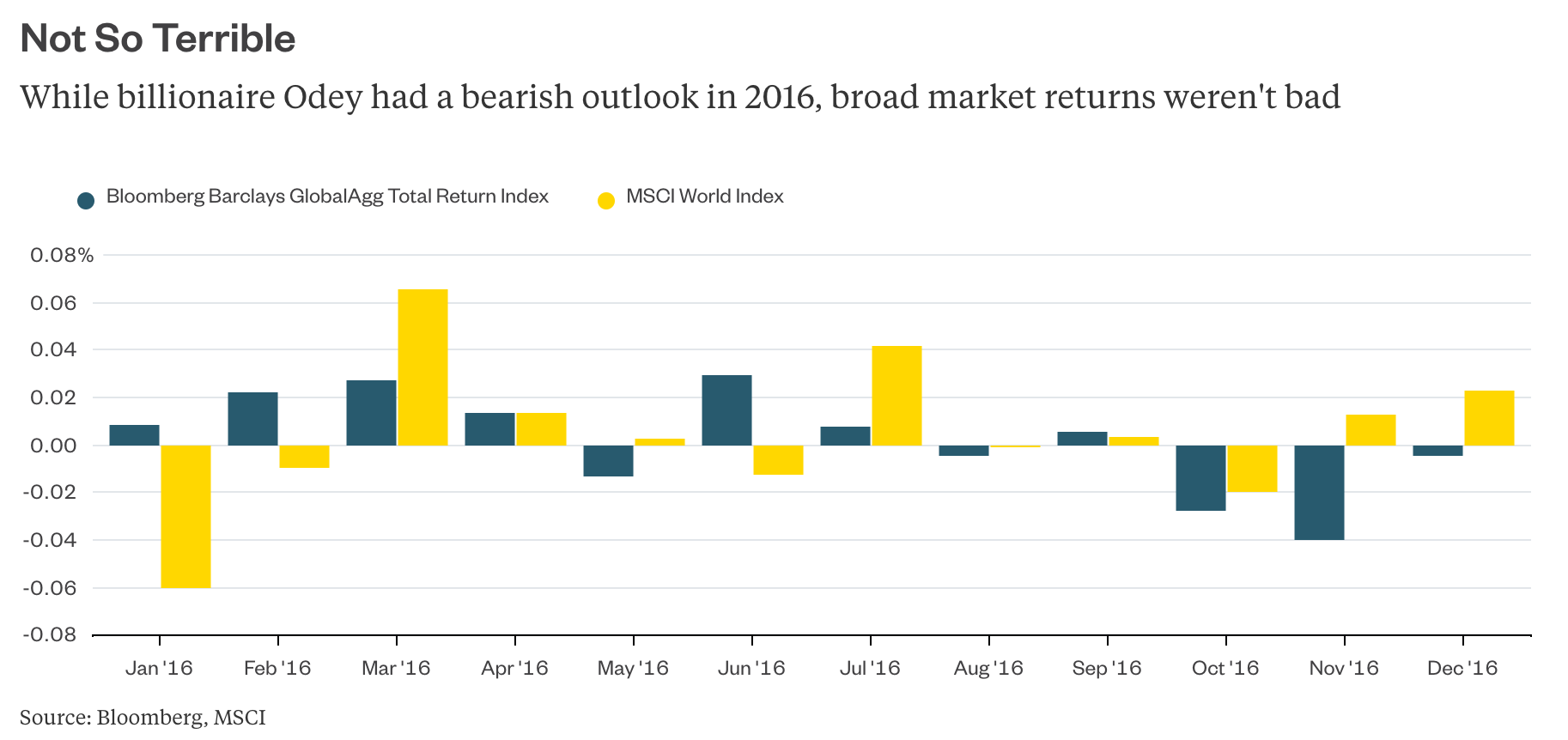

The fund's loss of 49.5 percent is especially bad considering that stocks globally were up more than 5 percent last year, and a broad benchmark of bonds worldwide gained an average of 2 percent. Even Odey's hedge fund peers, which have generally lagged behind broad benchmarks, posted returns of more than 4 percent.

Possibly worse than the number itself is Odey's excuse. He blames, in part, "mindless" investing, otherwise known as index funds. He said in a November letter that active money managers were being driven out by this type of investing, in which investors pay lower fees to put money into a predetermined broad sampling of securities.

“Passive investing has taken money which typically would have been in the bond market and deposited it in the equity market," he wrote in his note.

Odey was clearly wrong with many of his financial bets last year, which were largely bearish in nature. (For example, he believed that U.K. stocks could slump 80 percent after Britain's June 23 vote to exit the European Union, but they've rallied by 15.5 percent since then. He bet that shares of Ashmore Group and Anglo American PLC would fall in March; they rallied more than 10 percent in the first 14 days of the month alone.)

Perhaps more important, he was wrong to blame passive funds for the difficulties that active managers face. These strategies, which have grown increasingly popular for their low fees, ease of trade and transparency, will most likely provide more opportunities for active managers to outperform, at least over the long term.

Just take a look at fixed-income markets, which include everything from government bonds to corporate and consumer debt. Investors have flooded into index funds tracking these markets this year, pouring a record $90 billion into debt exchange-traded funds last year alone, according to data compiled by State Street Global Advisors.

These funds generally track broad benchmarks that include only a sampling of specific bonds. That leaves many bonds that these investors cannot access, nor can their funds respond quickly to news that may make a certain company or sector more or less appealing. While this hasn't mattered when markets were rising in general, it will make a difference as sentiment turns more mixed.

Indeed, Goldman Sachs Asset Management, BlackRock and Western Asset Management are all making an extra hard pitch for their unconstrained funds, even though they have generally underperformed. This is in large part because they're hoping they can take advantage of opportunities that passive funds can't.

Even Vanguard Group, which in some ways is the father of the indexing trend, sees potential for active bond-fund managers to distinguish themselves in coming years.

Odey can point to a lot of reasons for his notably poor performance. He can blame hubris for doubling down on convictions that didn't pan out. He can (and has) blamed central bankers for keeping a highly flawed world market afloat by manipulating all-important benchmark rates. But he should leave index funds alone. If anything, they may eventually give active managers like himself a chance to turn things around.

This column does not necessarily reflect the opinion of Bloomberg LP and its owners.

Lisa Abramowicz is a Bloomberg Gadfly columnist covering the debt markets. She has written about debt markets for Bloomberg News since 2010.

To contact the author of this story: Lisa Abramowicz in New York at [email protected] To contact the editor responsible for this story: Daniel Niemi at [email protected]