Back before Thanksgiving, we examined a couple of ways to trade the flattening Treasury yield curve. We were, in retrospect, a trade short.

Let’s back up a bit. The yield curve, a pictorial representation of the interest rates paid by Treasury securities of differing maturities, has been tamped down this year. Take the spread between the two-year note rate and the ten-year note as an example. At the top of the year it was 182 basis points (1.82 percent) wide. And now? Just 50 bps. The short end of the yield curve has been yanked up by Fed rate hikes while the long end’s actually slipped lower on diminished inflation concerns, among other factors.

In our November column, we highlighted the iPath US Treasury Flattener ETN (Nasdaq: FLAT) as a way to exploit further narrowing in the Treasury spread. FLAT, unfortunately, is VERY illiquid. You don’t need an appointment to trade it, you need a royal charter.

As an alternative, we suggested a spread trade: short the iShares 1-3 Year Treasury Bond ETF (Nasdaq: SHY) and long the iShares 7-10 Year Treasury Bond ETF (Nasdaq: IEF) done in a volatility-neutralizing ratio.

And then we heard from you.

Not in a good way. A lot of you groused about shorting an ETF (some thought it couldn’t be done; it CAN). Those who didn’t raise their voices about margining an ETF trade thought that the calculation of the short-long ratio was opaque and made the trade too cumbersome.

Well, we heard you. Allow us to proffer a simpler, non-margin solution: the old-fashioned barbell strategy.

Many investors are already familiar with barbells. As the name implies, weights are concentrated at the ends of a barbell. In this case, you’d own a slug of short term notes and another slug of long-term bond and eschew the middling paper.

Oh, I know it’s not a long-short strategy but it does a reasonable job of spreading the interest rate risk around if it’s weighted properly. And it’s not hard to figure out how to build the portfolio, either.

Enter Guggenheim’s suite of BulletShares targeted maturity bond funds—a nine-fund flotilla that allows investors to build ladders and barbells with maturities ranging from one to nine years out. You could, for example, buy the Guggenheim BulletShares 2019 Corporate Bond ETF (NYSE Arca: BSCJ) together with the Guggenheim BulletShares 2026 Corporate Bond ETF (NYSE Arca: BSCQ).

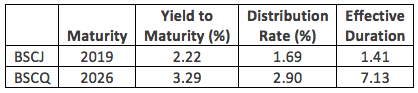

Yes, these are corporate bond funds, but a yield curve is a yield curve. Here’s how the two ETFs shape up:

If you weight the barbell equally by duration, you’d buy BSCJ in a 5-to-1 ratio to BSCQ. It’s easy to figure out the ratio. Just use the bond ladder tool on the BulletShares website.

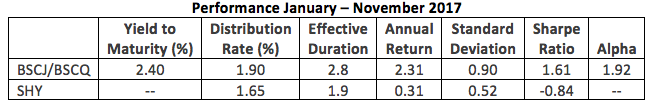

Here’s what the portfolio’s done this year compared to a Treasury-based ETF of similar duration, the iShares 1-3 Year Treasury Bond ETF (NYSE Arca: SHY):

The barbell strategy gives risk-wary investors a way to benefit from further flattening of the yield curve brought about by continued Fed funds hikes while allowing them to keep a toe in the long end for a better current yield.

There. Is that better? Let’s hear from you.

Brad Zigler is WealthManagement's Alternative Investments Editor. Previously, he was the head of Marketing, Research and Education for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.