The price of oil has almost doubled from a year ago, raising the question (to me anyway) whether there will be a hit to the consumer; this isn’t so far-fetched. There was a time when lower oil prices (we really mean gas prices) conformed to an uptick in consumer spending in the form of at-the-pump tax relief. Alas, this perspective and the potential correlation has weakened since that time which is to say that lower or higher oil/gas prices have less GDP impact and inflation to a degree than in the past.

This is about our use of energy. There is a concept called “Energy Intensity” which measures the amount of energy in British Thermal Units (BTUs) for each dollar of GDP. The measure, produced by the U.S. Energy Information Agency, has been in a steep decline since the 1970s and according to EIA projections will decline even further in coming years. Let’s put some numbers around this; back in 1974, for every dollar of GDP we consumed about 10,000 BTUs. (That’s in constant prices, i.e. adjusted for inflation.) That figure was more or less steady from the 1950s to the 1970s, but things changed in the late ‘70s and that figure has been dropping ever since.

At the end of 2014, Energy Intensity was down to 3,880 BTUs. A few years back EIA projected that figure would drop by nearly half about 20 years from now. It’s not just in the U.S. either. The EIA noted last July that energy intensity from 1990-2015 had dropped 32 percent as a world average, 32 percent in OECD countries and 40 percent in non-OECD countries.

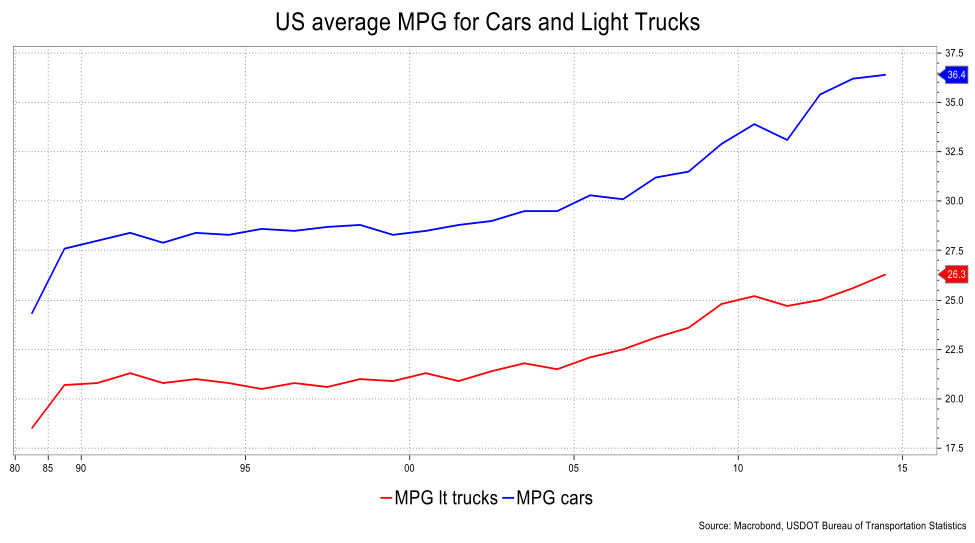

There are many reasons for this drop. First, at least in the U.S. and Western Europe, we are far less of a manufacturing economy which uses energy more than a service economy. Another reason is that we are more fuel efficient. Take cars for example; in 1990, the average car used 28 miles per gallon and light truck burned 20.8 mpg. By 2015, those figures were 36.4 and 26.3, respectively, according to Bureau of Transportation Statistics. The last 10 years have seen a particularly sharp ramping up in fuel efficiency and, with acknowledgement to potentially looser regulations under a Trump Administration, the EPA did reaffirm in December that the goal is for a 54.5 mpg target by 2025.

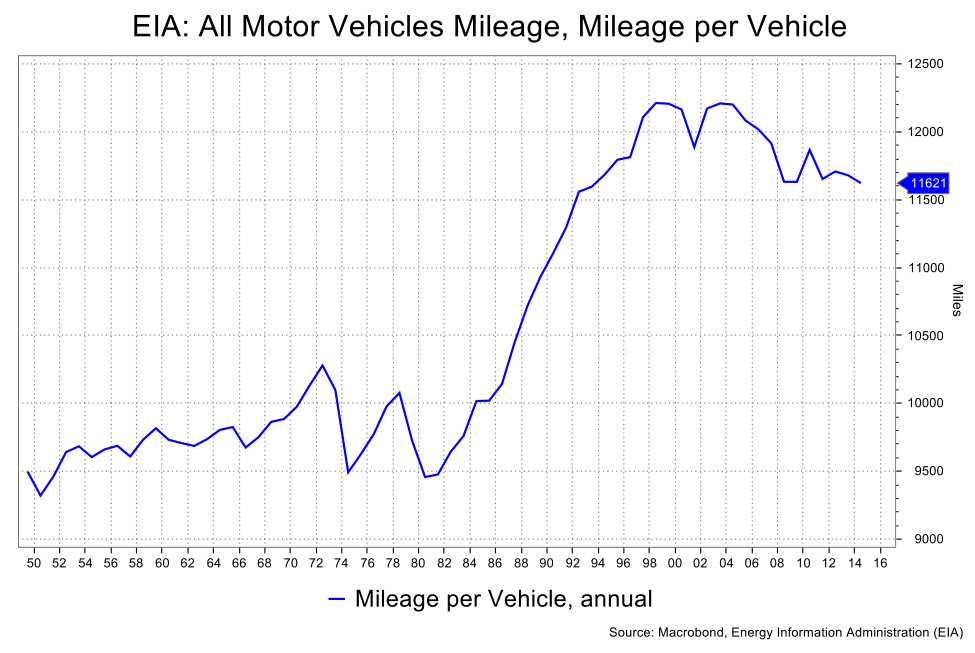

Also, we seem to be driving less. Once more the EIA relays that as of 2014 the average annual mileage of a vehicle had declined to 11,621 miles from over 12,000 from about 1996-2006. Think about it—better fuel efficiency and people are driving less. I’m tempted to take a stab at this and suggest that you have more urban youth riding bicycles around Brooklyn, a move back to cities for workers in general (or am I jaundiced by the financial sector in Fairfield County?), while aging baby boomers commute less as they wind down or fully retire.

In a curious twist of fate, as the U.S. becomes more of a fuel producer and less a consumer, lower energy prices could have an adverse economic impact. Gone is the windfall to the consumer and instead that’s replaced with stress on the energy sector. Granted the latter is not a big employer, but in GDP terms was perhaps the single largest contributor to business investment in the GDP equation until the oil bust of 2014.

This article originally appeared on Bloomberg View.

David Ader is the chief macro economist with Informa Financial Intelligence.