By Julie Verhage

(Bloomberg) --Want some volatility?

As investors fall back in love with stocks seeing the bigger swings, they should take a look at Biotech and Gold miners, according to Goldman Sachs Group Inc. In a new note from Katherine Fogertey and her team, the firms is suggesting that these sectors are going to be the ones that experience the biggest moves over the next 12-months.

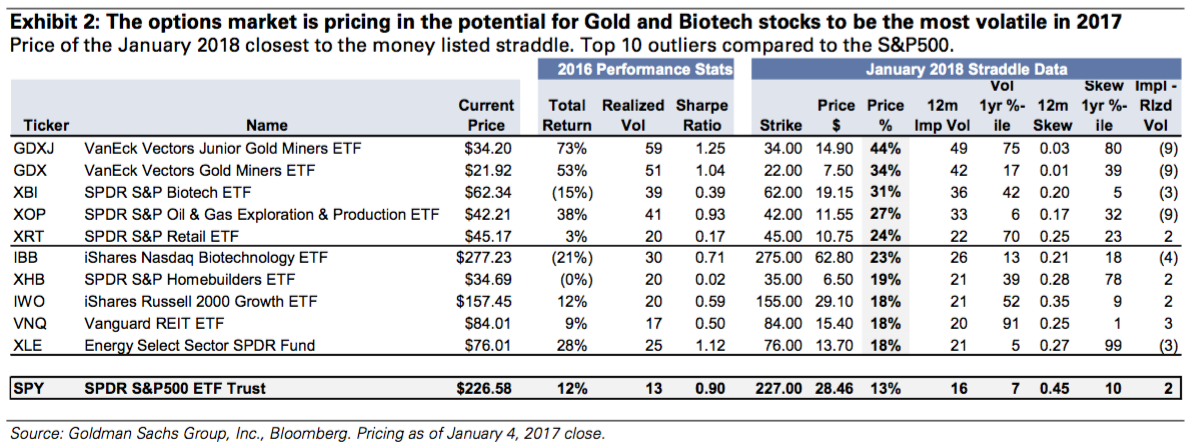

Fogertey came to her conclusions based on the options market, where she saw it "pricing in that Gold and Biotech equities will be the most volatile in 2017." Digging a bit deeper, her team added specific names of ETFs that could be a great way to play this trend. "Gold miners posted the best 2016 performance across our ETF universe, whether judged on an absolute or risk adjusted basis, and the options market is pricing in another big year for volatility for the VanEck Vectors Gold Miners ETF and the VanEck Vectors Junior Gold Miners ETF," they wrote. For Biotech, the team added that names including the SPDR S&P Biotech ETF and iShares Nasdaq Biotechnology ETF are also expecting the biggest moves.

George Pearkes, macro strategist at Bespoke Investment Group, points out that if history is any guide, this is likely to hold true. "Biotech and miners are highly volatile no matter what year it is, so those are unsurprising. It's just the nature of those businesses," he said in an interview.

But it's not just these sectors that are pricing in big moves if you drill down to a stock specific level. Goldman says the biggest upside potential comes from names including Facebook Inc., Caterpillar Inc., Oracle Corp., and Amazon.com Inc., amongst others. "We believe the options market is most underpricing our analysts’ bullish views in the 20 stocks listed [here]."

But if investors would rather stick to ETFs, here's a roundup of where the biggest moves are expected. While there is currently a 13 percent move expected for the S&P 500 index, the gold miners are each pricing in moves of more than 30 percent.

To contact the author of this story: Julie Verhage in New York at [email protected] To contact the editor responsible for this story: Joe Weisenthal at [email protected] Lorcan Roche Kelly