Since the days of the 2008-2009 Credit Crisis, we’ve been privy to many versions of the “new normal” story: It’s the “new normal” to have near-zero interest rates for years. Slower growth in China is touted as the “new normal.” And since the stock market recovery began in 2009, at times it may have seemed like the “new normal” was to see stock markets that only move in one direction--up.

Yet the current market volatility brings to mind a few enduring truths about market behavior that still prevail; we could call these tenets of the “old normal.” As anxiety levels climb among investors along with measures of market volatility, we take a moment to remind our clients just how normal today’s environment is. Here are a few ways:

1. It is normal to have equity down markets.

An extended bull market can cloud the fact that there are no givens in investing. While it’s encouraging to know that, from 1928 to 2014, annual S&P 500 returns were positive 72% of the time, we know that investing for the long term means having to navigate through periods of market weakness. This underscores the importance of diversification in mitigating downside risk and smoothing the ride for investors.

2. It is normal to have moderate pullbacks and corrections.

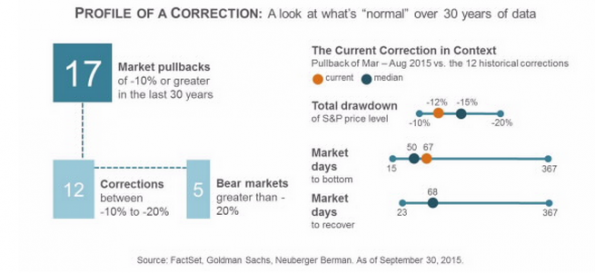

There have been 17 market pullbacks of 10% or greater in the last 30 years (see figure). Corrections are “normal” market behavior, even if they have been noticeably absent since 2011. For many investors, ourselves included, the recent August 2015 correction is a return to normal. For some, it represents a potentially attractive entry point for investments.

3. It is normal to feel anxious.

People have a well-documented aversion to loss. Behavioral researchers find that we all feel losses more acutely than same-sized gains. In fact, a seminal study showed that investors feel losses about 2 – 2.5x more than they feel gains.1 It’s an incredibly powerful emotional response that can take hold in volatile environments, leading investors to question the carefully laid long-term investment plans they made in calmer times.

A key point we stress with clients is that there is a distinction between declines in value and realized losses. When you see the market lurching back and forth from day to day, oftentimes “paper losses” show up on account statements. These paper losses become realized losses if you sell, so we caution clients against making emotional decisions in volatile markets. A key role of an advisor is to help clients objectively evaluate potential changes and manage emotions. Changes can be warranted, but maintaining long-term strategic asset allocations and staying the course often winds up being a prudent decision.

Brian Hahn is a Managing Director and Wealth Advisor at Neuberger Berman, where he advises high net worth individuals and families on customized investment solutions. To learn more, see his bio or visit www.nb.com.

This material is provided for informational purposes only and nothing herein constitutes investment, legal, accounting or tax advice, or a recommendation to buy, sell or hold a security. Information is obtained from sources deemed reliable, but there is no representation or warranty as to its accuracy, completeness or reliability. All information is current as of the date of this material and is subject to change without notice. Third-party economic or market estimates discussed herein may or may not be realized and no opinion or representation is being given regarding such estimates. Any views or opinions expressed may not reflect those of the firm as a whole. Information presented may include estimates, outlooks, projections and other “forward looking statements.” Due to a variety of factors, actual events may differ significantly from those presented. Neuberger Berman products and services may not be available in all jurisdictions or to all client types. Investing entails risks, including possible loss of principal. Diversification does not guarantee profit or protect against loss in declining markets.

Unless otherwise indicated returns shown reflect reinvestment of dividends and distributions. Indexes are unmanaged and are not available for direct investment. Past performance is no guarantee of future results.

Neuberger Berman LLC is a Registered Investment Adviser. The “Neuberger Berman” name and logo are registered service marks of Neuberger Berman Group LLC.

© 2015 Neuberger Berman Group LLC. All rights reserved.

1 Source: Kahneman, Daniel & Amos Tversky. “Prospect Theory: An Analysis of Decision under Risk.” Econometrica Vol. 47, No. 2. (1979): 263-292.