By Ben Carlson

(Bloomberg Prophets) --Sir John Templeton wrote “16 Rules for Investment Success” in 1993. The following is by far the most quoted passage:

The investor who says, ‘This time is different,’ when in fact it’s virtually a repeat of an earlier situation, has uttered among the four most costly words in the annals of investing.

“This time is different” is something of a sacrilegious phrase in the investment industry. Every time markets, corporate fundamentals or long-followed economic ratios enter above-average territory there are sure to be pundits or investors warning about complacency and imminent mean reversion. Anyone who claims it’s different this time is mocked with disdain for daring to question long-term financial relationships.

Although mean reversion plays a huge role in the financial markets -- above-average performance tends to lead to below-average performance, and vice versa -- investors must be flexible about the averages they’re using in their analysis.

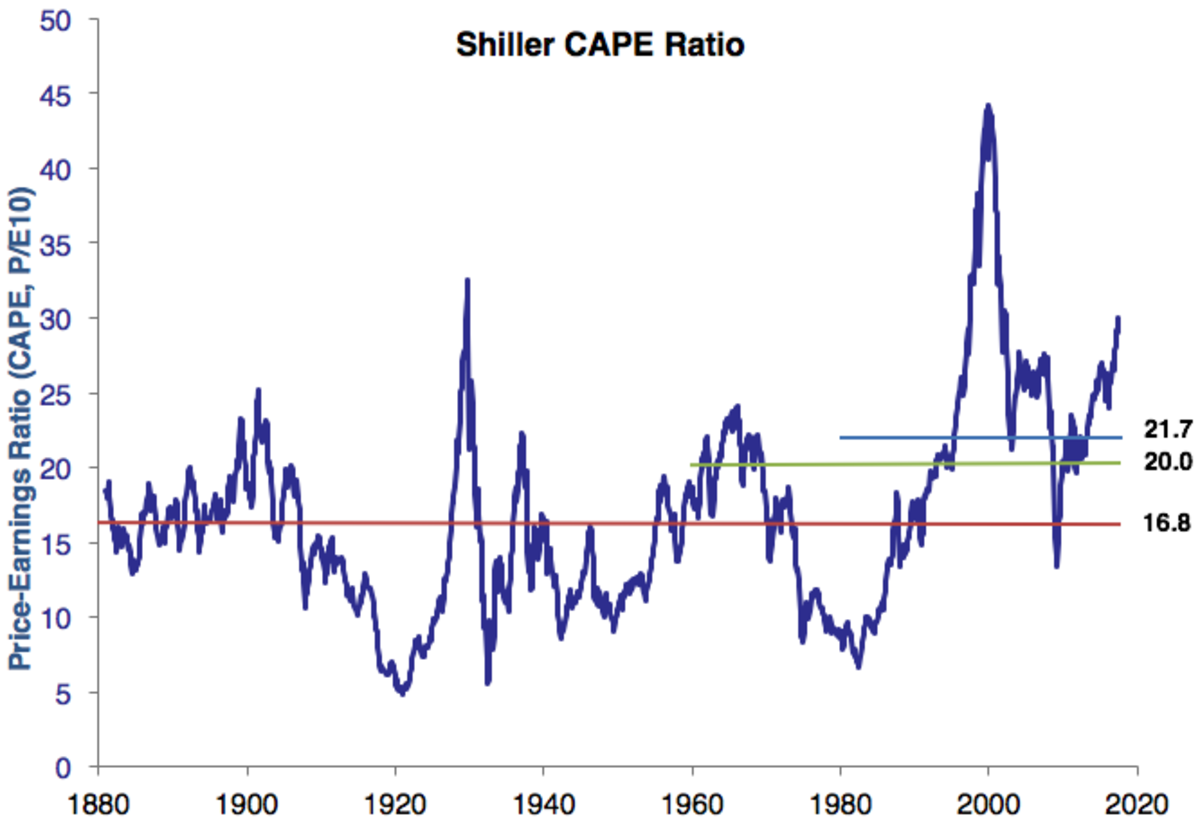

For example, the CAPE ratio is far above its long-term averages, which date back to 1871. But look at the differences in the average from various starting points since then:

The average CAPE since 1871 is 16.7, but if we take the average from 1960 it jumps to 20, and from 1980 the average is 21.7. The current reading of 30 is elevated when looking at each of these averages, but the question for investors becomes: Which long-term average is the most representative of today’s markets?

The composition of the corporate world and financial market structure are also completely different today. Consider the following:

- In 1957, the S&P 500 consisted of 425 industrial stocks, 60 utilities and 15 railroads. Financial stocks were not added to the index until the 1970s. Until 1988, the composition of the S&P 500 was 400 industrial stocks, 40 utilities, 40 financials and 20 transportation stocks.

- In 1902, America’s largest company, U.S. Steel, employed almost 170,000 people with sales of $561 million or $3,340 of sales per employee ($90,000 in today’s dollars). Today, Facebook generates $2 million in revenue per employee.

- Fifty years ago, retail investors accounted for more than 90 percent of all New York Stock Exchange trading volume. Today, 95 percent of trading is performed by professional investors.

- Before the Securities and Exchange Commission deregulated the brokerage industry on May Day in 1975 and abolished fixed-rate commissions, it was extremely cost-prohibitive to trade securities on the exchanges. Trading costs, including bid-ask spreads and commissions, have fallen on the order of 80 percent to 90 percent since then.

- Mutual fund sales loads averaged 8 percent to 10 percent in the 1950s.

- The first stock market index fund wasn’t created until 1976. The first bond index fund didn’t come around until late-1986.

- The 401(k) is roughly 30 years old. IRAs aren’t much older. The entire concept of retirement is largely a 20th-century phenomenon. In the past, people didn’t really save for retirement because the concept didn’t really exist until World War II. People typically worked until they died.

Not only is this time different, but it’s different every time. This is why so many investors are able to create market-beating strategies with the benefit of hindsight that go on to underperform in the real world. Markets are constantly evolving based on our updated knowledge of the past.

Outperformance can evaporate. Flows into certain products or strategies can change their fundamentals. Any asset can become a wonderful investment at one price and a terrible one at another.

Historical context is critical for understanding the financial markets. What else do investors have to go by? But you have to put things into perspective and realize that markets are a complex adaptive system. They’re not static and they don’t always follow preset rules.

Since we’re providing context, here is what Templeton was actually talking with his famous four words. This was the lead-in to that statement:

The only way to avoid mistakes is not to invest -- which is the biggest mistake of all. So forgive yourself for your errors. Don’t become discouraged, and certainly don’t try to recoup your losses by taking bigger risks. Instead, turn each mistake into a learning experience. Determine exactly what went wrong and how you can avoid the same mistake in the future.

And here’s the follow-up:

The big difference between those who are successful and those who are not is that successful people learn from their mistakes and the mistakes of others.

Templeton wasn’t talking about financial ratios or models when he stated that the four most dangerous words are “This time is different.” He was talking about human nature. That’s the one constant that remains in the markets.

One definition of insanity is doing the same thing again and again and expecting a different result. This is what Templeton was referring to with the four most costly words in the annals of investing.

This column does not necessarily reflect the opinion of the editorial board or Bloomberg LP and its owners.

Ben Carlson is director of institutional asset management at Ritholtz Wealth Management. He is the author of "Organizational Alpha: How to Add Value in Institutional Asset Management."

To contact the author of this story: Ben Carlson at [email protected] contact the editor responsible for this story: Max Berley at [email protected]

For more columns from Bloomberg View, visit bloomberg.com/view