It seems like everybody hates Mondays. Inflationistas thought this past Monday particularly noxious as market-implied inflation expectations skidded to 15-month lows. The yield spread between conventional 10-year Treasury notes and their inflation-protected siblings shrank to 1.99 percent on Monday, the narrowest since June 2013.

The spread, typically referred to as the breakeven inflation (BEI) rate, serves as benchmark for bond investors. If the inflation rate represented by the Consumer Price Index (CPI) rises above the breakeven rate, Treasury Inflation-Protected Securities (TIPS) become attractive; when CPI dips below BEI, the real return on conventional bonds is more alluring.

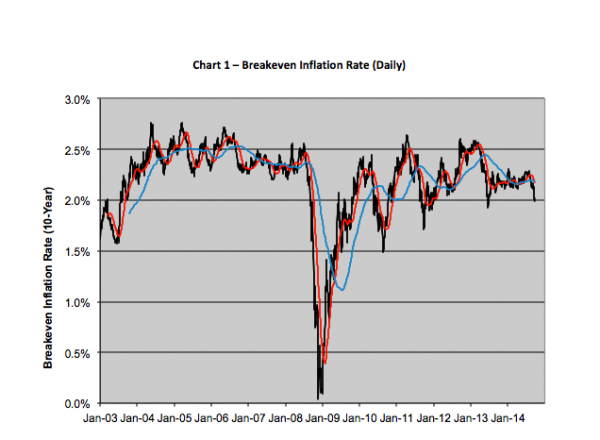

Put simply, BEI is a rough forecast of the annual inflation rate for the next decade. It’s been a pretty volatile indicator over the past five years. Inflation prospects plummeted to just nine basis points (0.09 percent) in the depths of the Great Recession (see Chart 1) only to rebound—with a few stutter steps—to range between 200 and 250 basis points currently.

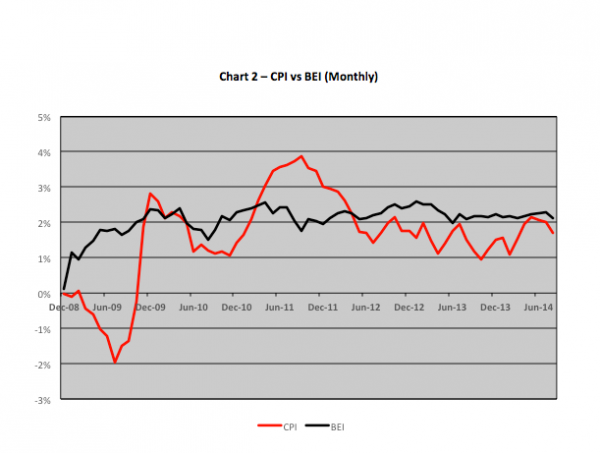

Since December 2008, BEI has averaged 2.08 percent. Meantime, CPI has averaged just 1.60 percent (see Chart 2).

Investors beat up on TIPS after the minutes of the last Federal Open Market Committee meeting was released, backing up ten-year rates by as much as 13 basis points. At the same time, conventional note yields ticked just three bips higher.

Commodity prices factor significantly into inflationary expectations, so it’s really no surprise that TIPs were mauled. The Thomson Reuters/CRB Commodity Index has slumped eight percent since the first quarter, largely led by a softening in oil prices. Last week alone, as investors digested the Fed news, crude oil dropped more than one percent.

Normally, hikes in commodity prices set the stage for a buildup in inflation expectations, particularly if global economic activity is robust. That’s clearly not the case now. Not yet anyway.

Brad Zigler pens Wealthmanagement.com's Alternative Insights newsletter. Formerly, he headed up marketing and research for the Pacific Exchange's (now NYSE Arca) option market and the iShares complex of exchange traded funds.