Developed Markets Equity Funds posted collective net outflows for the second straight week going into the final days of April as higher energy prices prompted investors to revisit their assumptions about inflation, interest rates and economic growth in the U.S. and elsewhere. Investors pulled money out of Europe Equity Funds for the seventh straight week and from U.S. Equity Funds for the eighth time in the past 12 weeks, more than offsetting modest commitments to Japan Equity Funds and more robust flows into Global Equity Funds.

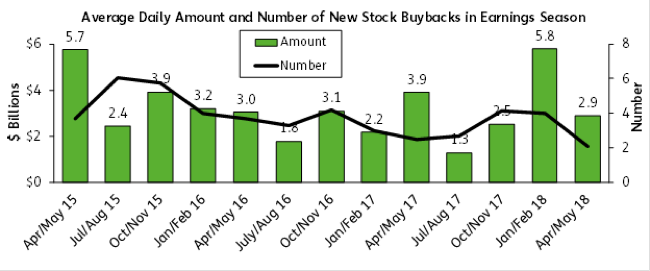

U.S. Equity Funds, which enjoyed a lift in mid-April as the first quarter earnings season kicked off strongly and fears of an all-out trade war with China abated, saw flows turn negative again during a week when the yield on the 10-year Treasury breached the symbolic 3 percent level. Fears that the current crop of earnings may be as good as it gets and that higher bond yields will sap investor demand for equities, weighed on investor sentiment. So did the relatively slow pace of share buybacks, a source of market support that investors expect to accelerate as the recent corporate tax reforms encourage companies to repatriate cash currently held offshore.

According to EPFR sister company TrimTabs Investment Research, “[S]o far this earnings season buybacks have averaged $2.1 billion to $2.9 billion daily. While the volume is respectable, the number of announcements is on the low side and buybacks by four companies—Broadcom ($12.0 billion), Facebook ($9.0 billion), Waters ($3.0 billion), and Franklin Resources ($2.6 billion)—have accounted for two-thirds of the volume."

Japan’s corporate earnings season is beginning to pick up steam and will kick into high gear during the second week of May. Foreign investors have pulled back ahead of those earnings reports until the impact of a stronger yen on exporters becomes clearer. Yen-denominated commitments again accounted for all the modest overall inflows recorded by Japan Equity Funds.

Currency strength and its impact on exporters remains a headwind for Europe Equity Funds, which are also hobbled by fears about the resurgence of populist parties, concerns about the impact of higher energy prices on already slowing growth, the possibility that the European Central Bank will wind up its quantitative easing program by the end of the year and the uncertainty surrounding the U.K.’s exit from the European Union. This fund group has now posted outflows for seven straight weeks, their longest run since a 39-week streak ended in 4Q16.

Managers of diversified Europe Equity Funds have rotated their country exposure to northern tier markets over the past 12 months, with Germany’s average allocation at its highest level since 4Q12.

The largest of the diversified Developed Markets Equity Fund groups, Global Equity Funds, continue to take in fresh money. Year-to-date, funds with ex-U.S. mandates have attracted 2.5 times the amount absorbed by their fully global peers.

Cameron Brandt is Director of Research for EPFR Global, an Informa Financial Intelligence company.