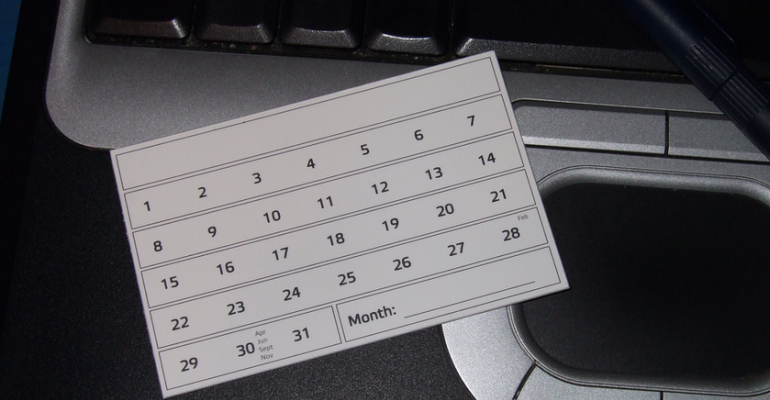

Why are most wealth advisors still a slave to the calendar? It’s a question worth examining because there’s no real reason for it.

The calendar is a convenient organizing principle, but it is in no way the optimal one for taking care of wealth management clients in the 21st century.

Three Areas Where the Calendar Currently Rules

Through their investment consulting, wealth advisors add value for clients in three ways. All of these have been under the thumb of the calendar.

The first is rebalancing a client’s investment portfolio. Most wealth advisors wait until the end of the year. That’s the way it’s always been done. However, some do take up the task more frequently, usually at quarter-end.

With the volatility in the markets and the speed with which they now move, intra-quarter portfolio balancings are a better approach. Why should clients have to wait for the calendar to initiate something that should be done when it’s needed?

The second area dictated by the calendar is tax-loss harvesting. This also has been a year-end ritual. However, one of the best wealth managers we know has been tax-loss harvesting throughout the year – whenever the opportunity presents itself. That’s absolutely the right approach. It’s also proven very successful for his clients.

The third area where the calendar has disproportionate influence is in selecting money managers based on 3, 5, 7 or 10-year investment performance.

Over the past week, five-year manager performance has caused a buzz because the numbers from the financial crisis are now rolling off. It’s a new day for investment managers who were hammered by the events of March 2008.

Relying on any calendar timeframe for picking managers is particularly perilous. A manager can go from a poor performer to a top performer in just one day. We all know that’s not right, but those are the vagaries of the calendar.

In fact, money manager diligence should be more qualitative than quantitative. Qualitative due diligence needs to be an operational core competency of a wealth management firm – one that never ceases.

The Breakaway Calendar

The calendar has also controlled when breakaway brokers move from wirehouse to wirehouse. Historically, wirehouse brokers would move on a three-day weekend, which offers the maximize time to get organized and inform clients.

That may soon change.

The Wealth Consigliere believes that FINRA’s recent recommendation that brokers disclose the recruiting checks they receive when switching firms is likely to slow down the movement between Wall Street firms. The SEC will almost certainly make FINRA’s recommendation the law of the land.

There’s an old saying that a stock doesn’t know you own it. That might be expanded to say the calendar doesn’t know anything about wealth management.

But you do.

Jeff Spears is Founder and CEO of Sanctuary Wealth Services, champion of the independent advisor and author of the acclaimed blog, Wealth Consigliere. Follow Jeff on Twitter and Facebook.