San Diego: “The new data you shared regarding the affluent consumer is, to say the least, very sobering,” remarked Gerry before asking, “Do the affluent trust anything?”

As one of the 80 financial advisors attending our recent Affluent Marketing Symposium that we’d framed around our 2015 Affluent Investor and Affluent Consumer research projects, Gerry was asking what many were thinking. Complete Affluent Immersion was our theme, as we emphasized the importance of financial advisors having a broader understanding of today’s affluent beyond the behavioral finance trend.

During my workout the following morning, I found myself listening to Quicksilver Messenger Service’s “Who Do You Love?” With Gerry’s question rattling around in my mind, Quicksilver’s question being melodically repeated in my ear, it dawned on me that the question for financial advisors is Who do your affluent clients trust? The short answer better be you!

But how, as a financial advisor, do you know? Our research tells us that affluent clients and financial advisors have differing perceptions on a number of issues. For instance, 74% of advisors claim to have a business and social relationship with their affluent clients, whereas only 28% of affluent clients feel the same way. 52% of financial advisors expect to retain their client’s children, yet only 28% of affluent clients say their advisor has shown any interest in working with their children.

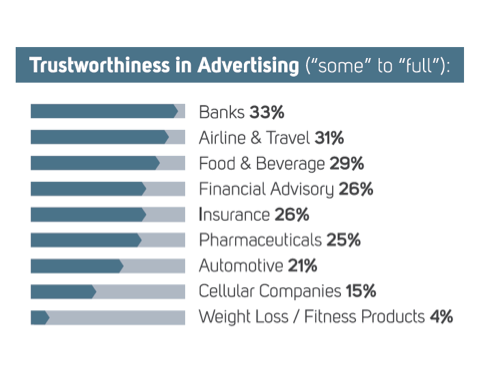

The disconnect is obvious. And when you look at today’s affluent trust factor toward advertising (chart below), to Gerry’s point, it’s sobering.

Should this be considered sobering … or an opportunity? Let me share the consensus of the peer-to-peer exercise these financial advisors engaged in following Gerry’s question.

Tremendous opportunity!!

As one advisor put it, “This is our time to shine.” The discussion between these financial advisor peer groups was on the money. Sure, today’s affluent consumer is extremely skeptical, but rightfully so. How much trust do you place in the ads that you view? This high level of affluent cynicism is a financial advisor’s opportunity to shine. The following are a handful of actionable ideas that were discussed:

- Personalize every aspect of your service model (eliminate any cookie-cutter contact system).

- Personalize all communication and correspondence (eliminate all impersonal e-newsletters, research reports, etc. unless client wants them).

- Follow through on everything (do promptly what you say you’re going to do).

- Be involved with the multi-dimensional aspects of their family’s financial affairs.

- Get social with every affluent client (at least twice a year).

- Work the children of each affluent client.

- Surprise and delight each affluent client (twice a year).

None of this is complicated. And the good news is your affluent clients are not likely to be receiving anything close to this type of personal attention, competency and professionalism. As I outlined the 3-Step Client Relationship Builder process in the last issue, it’s important to assess each client relationship, create a relationship calendar, and get to work.

Trust is the fuel that activates the relationship management / relationship marketing nexus. Yes, financial advisors—it’s your time to shine.

Matt Oechsli is author of Building a Successful 21st Century Financial Practice: Attracting, Servicing & Retaining Affluent Clients. www.oechsli.com