Fraudsters beware, says the Securities and Exchange Commission in its latest investor-focused public service announcement. In an effort to crack down on the likelihood of Main Street investors turning over their life savings to unregistered investment professionals, the SEC is running snappy social media-friendly videos encouraging due diligence with a visit to Investor.gov. The SEC-run website provides resources for at-large public investors, including an easy-to-access link to the Investment Adviser Public Disclosure database, which returns information on investment professionals registered with the SEC and FINRA’s BrokerCheck. “Investors who check the background of their investment professional and use the other tools and resources available on Investor.gov can make more informed investment choices—and better protect themselves from fraud,” said Lori Schock, director of the SEC’s Office of Investor Education and Advocacy. The site has seen more than 9 million new users since its launch and provides individual investors with financial planning tools, tips for safeguarding their assets and links to the SEC’s investor complaint form.

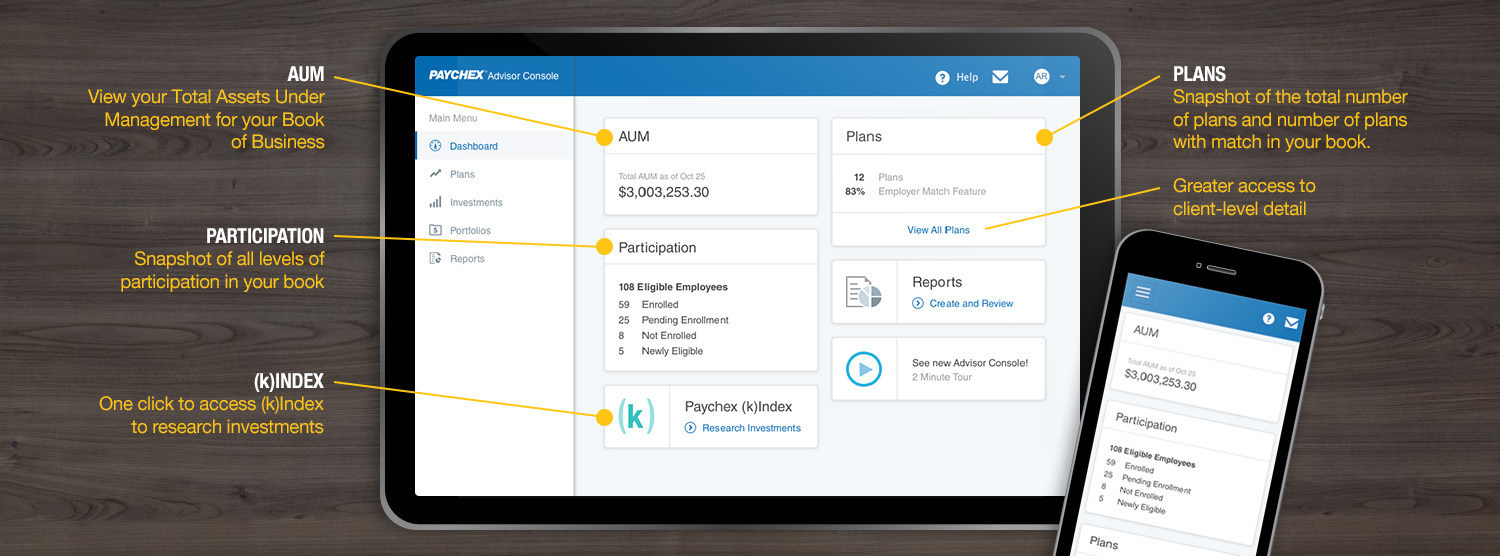

Paychex Adds Features to Simplify Managing Plan Investments

Paychex, which provides 401(k) recordkeeping services, said it’s adding several new features to its Advisor Console, the portal that plan advisors use to manage their books of business with Paychex. Among the changes are more readily available client data relevant to newly eligible employees, employees pending enrollments and employees who have not yet enrolled. Later this year, it will also roll out tools that enable plan advisors to benchmark their plans against industry standards.

NJ Advisor Pleads Guilty in $3.1 Million Fraud

A Farmingdale, N.J. financial advisor has pleaded guilty to defrauding his clients out of $3.1 million, according to the U.S. Attorney's office. Scott Newsholme, 43, pleaded guilty to wire fraud, aggravated identity theft and preparing fraudulent tax returns. Court documents show that from 2002 to 2017, Newsholme convinced his clients to give him money, which he said he’d invest in various securities, as well as bond instruments issues by a private New Jersey country club, a bond investment in a video game company and investments in the production of a movie. Instead, however, he cashed or deposited the checks and used the investments for personal expenses, including multiple cars, bedroom furniture, debts at casinos, bank transfers to his personal accounts and ATM withdrawals. In total, he faces more than 20 years in jail and fines in excess of $500,000.