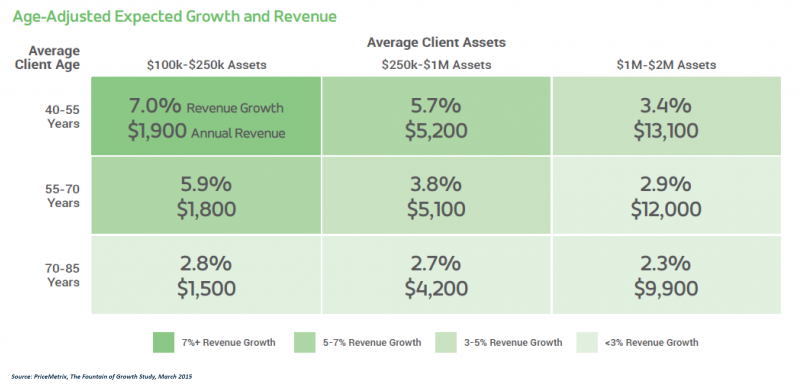

There are good reasons to avoid younger clients with less than $250,000 in assets, but these investors can be good for long-term growth, according to a new study from PriceMetrix.

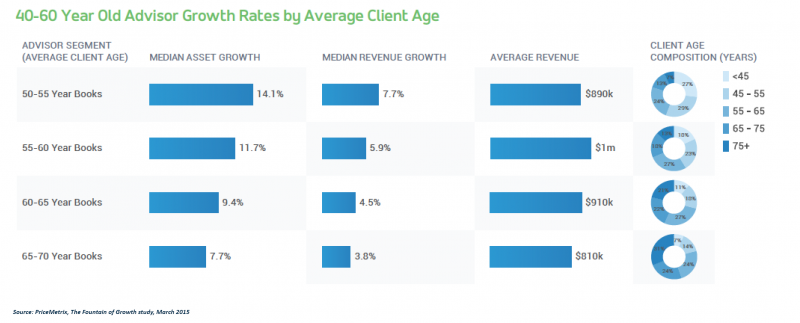

The majority of advisors, both young and old, target older investors as clients. Older clients certainly have higher assets and generate higher, short-term revenue, but advisors with younger clients grow faster over the long haul than advisors with older clients, according to PriceMetrix' The Fountain of Growth study released Monday.

An advisor with a significant number of clients under 45 will grow an average of 14.1 percent a year with annual revenue of $890,000, compared to an advisor with a majority of older clients who has current revenue of $810,000 and an expected growth rate of 7.7 percent per year.

“Which book would you rather have, an aging group of clients or a younger, more dynamic mix,” says Doug Trott, president and CEO of PriceMetrix. “Yet, today, most firms will treat and reward these two books the same."

Trading current revenue for long-term growth may be unappealing for some, but there are significant advantages, according to the study’s data. Return on assets is 25 percent higher for advisors with younger clients and these advisors tend to service a higher proportion of fee-based accounts.

“The demographic lesson here is clear,” Trott said. “In order to maintain growth, advisors and firms have to understand and take into consideration the age of both advisors and clients when they’re considering the proper mix of their businesses.”