The recently launched XY Planning Network—an organization young financial planners who work with Next Gen clients—is exploring a partnership with Betterment Institutional, the online investment platform’s turnkey asset management program designed for advisors.

“Financial planning is a very inefficient process because it’s very time-intensive, very service-heavy,” said financial planner and XY Planning Network Co-Founder Alan Moore. “There’s a reason a lot of advisors cap out at 75 to 100 clients because they just can’t serve any more than that given the client-facing activities as well as the back office.”

Instead of focusing on giving financial advice, many advisors are spending a lot of time rebalancing portfolios and researching mutual funds, Moore said. But online platforms like Betterment and Wealthfront do the investment management. They use intricate trading and rebalancing technology with no trading costs.

The potential partnership, Moore said, would allow the Network’s advisors to provide investment-related services to clients without overly burdening the advisor.

“What a lot of more experienced advisors would be shocked to learn is how few of our advisors really want to manage investments,” Moore said. “Their passion is giving financial advice to their peers.”

But the trading and rebalancing platforms like Betterment and Wealthfront are not the only type of robo-advisors that flesh and blood advisors need to embrace. Another group of robos include LearnVest and Personal Capital, which are still very tech-heavy and low-touch, but they actually have CFPs on their staff who investors can talk to.

These platforms, however, are going to groom the ideal future clients for advisors, Moore said.

“It’s going to work for your smaller clients that have a little more basic replicable needs,” Moore said. “As the clients grow and things get confusing and more intricate, either LearnVest is going to have to provide a more higher touch service, or they will go to a higher touch advisor because over time that’s what you need.”

Moore believes advisors have to find ways to embrace the robo-advisor platforms, partner with them, or risk getting left behind.

“You’re not going to stop the Wealthfront, Betterments,” he said. “You’re not going to be able to convince the marketplace that these are horrible companies. They’re doing too much good work, and they’re creating too much good stuff.

“You better be on board or you’re going to get eaten alive.”

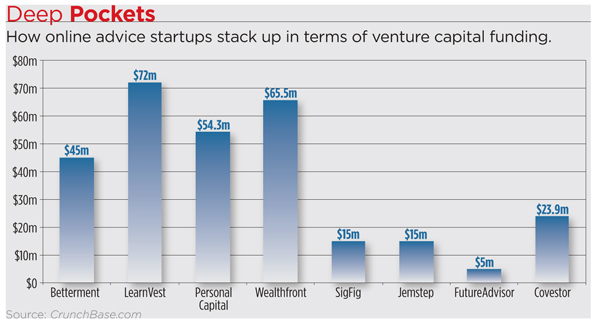

They're not, as he puts it, going away. Here's a look at how much venture capital the online advice startups have raised so far, according to CrunchBase.com: