While two-thirds of American employees have increased their focus on retirement in the last five years, a recent Merrill Lynch study found many still lack confidence in their ability to save enough.

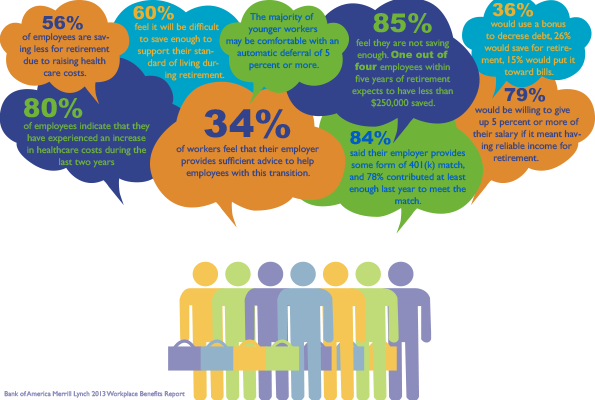

According to the Bank of America unit’s 2013 Workplace Benefits Report, 85 percent of the 1,000 employees surveyed say they are still not saving enough and 78 percent see themselves working into their late 60s and 70s.

But the study also found that four out of five employees would be willing to trade in 5 percent or more of their salary to secure a reliable income source during retirement.

“Too often financial stress and the weight of uncertainty surrounding one’s ability to accomplish their goals can cause them to remain inert and unwilling to look truths about their financial future in the eye,” says Merrill Lynch’s director of behavioral finance Michael Liersch Ph.D.

A majority of employees said they needed help most with retirement advice and guidance, but 58 percent they were seeking advice “across all aspects of their financial life.” Good news for advisors to be sure, but also a call to employers that people need access to personalized advice that goes beyond retirement goals.