For the last several years, industry experts (and WealthManagement.com) have talked about the small independent broker/dealer as if it were an endangered species. Sure, many small b/ds—bogged down by increasing regulation, compliance costs, litigation, and competition—have closed their doors. But new data from Fishbowl Strategies suggests that a turnaround may be in the cards.

In May, 15 broker/dealers went out of business, compared to 25 that closed up in May 2012 and 18 that shut down in May 2011, according to David Alsup, founder of Fishbowl Strategies, which tracks changes in firm registrations at FINRA. Meanwhile, 11 firms opened up in May, compared to six new firms in May of last year.

Alsup attributes the decline in b/d closings to the rise in the equity markets this year. An increase in trading activity has given a much-needed lift to b/ds’ margins. “You have a market up, very strong, so there’s a little more profitability.”

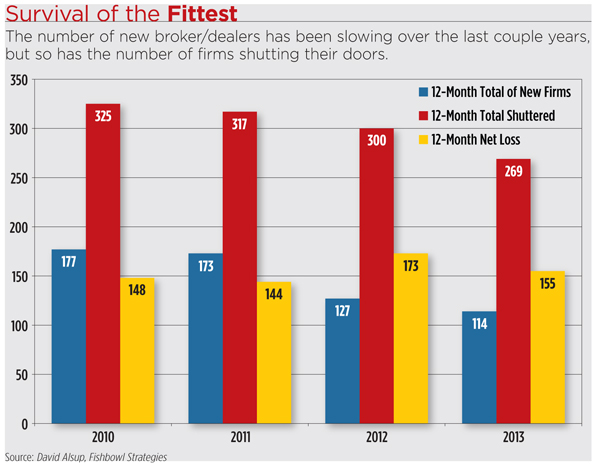

Another good sign is that the gap between the number of firms opening and closing is narrowing, Alsup said. The three-year average has dropped to 11.4 new formations and 24.8 closures per month. And while the 12-month ratio is still a net loss (155 firms), that loss has declined year over year. (See chart, below.)

But the trend that people aren’t opening up as many new b/ds as they used to continues, and Alsup expects that number to waver around 11 each month until the end of the year.

“The overhead from the standpoint of overregulation is so difficult to get a new firm admitted to FINRA,” Alsup said. “It’s much more difficult than it used to be.”

Despite the slowing trend of b/d closings, Alsup still doesn’t have much hope for the small broker/dealer. He expects the industry to continue to consolidate, and for small firms to be gobbled up by others to survive.

“You’ve got to get bigger,” he said. “Unless you’re in a real narrow niche where you’re managing hundreds of millions, with a sidebar RIA, you’ve got to add personnel. You need compliance people; you need back-office people. It takes manpower; it takes money to do this.”