Prudential Investments, the mutual fund and separate account unit of Prudential Financial (NYSE: PRU), has historically been a pretty quiet contender for assets among advisors, content to focus much of its efforts on the wirehouses prior to the financial crisis. But the asset management arm is now more aggressively marketing its investments products to all advisors channels and has been ramping up its wholesale force in the last 12-18 months.

In the summer of last year, the firm started hiring wholesalers dedicated specifically to the independent channel, said Stuart Parker, executive vice president and head of retail mutual fund distribution at the firm, who stopped by our offices Monday. The firm currently has 23 wholesalers dedicated to the independent channel, and Parker plans to be fully staffed to about 30 by year-end. Prudential also plans to add seven in the defined contribution space as well as four in the RIA space, but the big growth area seems to be the IBDs.

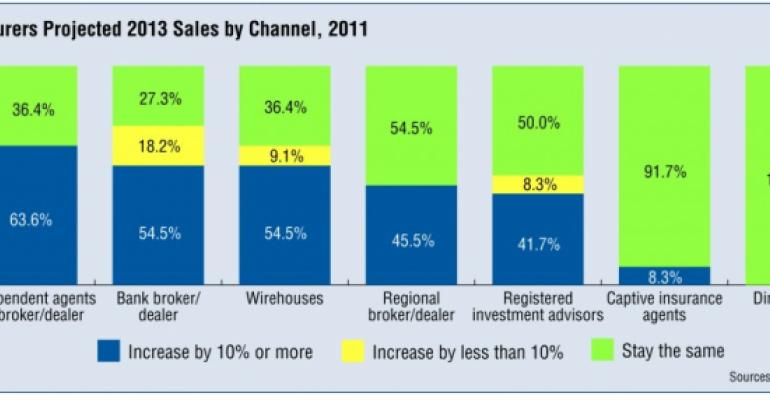

In fact, insurers expect the IBD channel to provide the greatest opportunity for sales in the future, at least on the annuity side (data from Cerulli Associates and Insured Retirement Institute):

Granted, this is variable annuities, but this goes to show that product providers depend on the IBD channel for sales growth. Prudential is counting on its brand recognition, its new sales force and its income-oriented products to more aggressively reach all channels. Before the crisis, it would appear that Prudential was a sleeping giant so to speak, ranked number 575 in net asset flows. Post-crisis, it would appear that the sleeping giant has awoken, coming in at number 18 in net flows. Not bad.

Timing is everything. When people wanted to start putting money to work after the crisis, firms like Prudential emerged, Parker said. He believes they had the right type of products at the right time, such as its short-term corporate bond fund and other fixed income funds that promise protection.

Also, while some of the other guys are trying to reach advisors through digital technologies, Prudential President Judy Rice said getting in front of advisors themselves has worked best for them.

Everyone has a different way of doing things, but it should be interesting to see if their efforts bear fruit, especially on the independent side.