Global assets in alternative investments are expected to grow from $11.3 trillion today to $15.3 trillion by 2020, according to a new report by PwC. The growth will be driven primarily by increased participation from sovereign investors, who are expected to boost allocations to private equity, real estate and infrastructure, in particular. In the next five years, alternative managers will develop more sophisticated strategies, more focused distribution channels and better recognized brands, PwC says. Managers are also expected to move into areas traditionally dominated by banks, such as lending, securitization and financing.

Convergent Names New President

Convergent Wealth Advisors has appointed John T. Elmes as its new president. Elmes succeeds Douglas Wolford, who was named CEO after David Zier passed away in October. Elmes will be responsible for the client-facing organization, business development efforts and the investment strategy. Prior to joining Convergent, Elmes served as managing director of J.P. Morgan Private Bank.

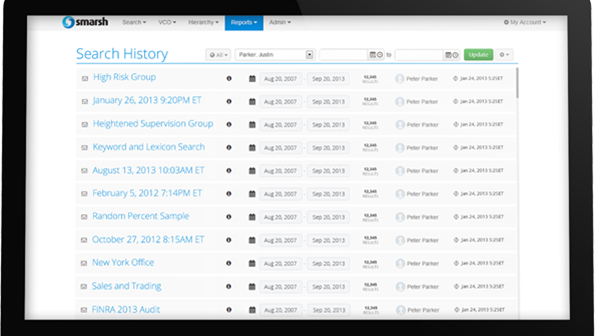

Smarsh Revamps Digital Marketing Services

Smarsh re-launched its professional website design offering for financial advisors as a separate company called Advisor Launchpad on Monday. The new company aims to provide advisors with well-designed, mobile and SEO-friendly websites, as well as additional digital marketing services such as social media support, copywriting solutions, email marketing and a library of targeted content. Plans start at $69 a month.

Two Weeks of Memories, Two Years of Debt

Your social media feeds are likely flooded with photos of friends and family enjoying their summers in exotic locales, but that doesn’t mean they were financially prepared for their trips. According to a new study by credit data monitoring company Experian Consumer Services, 46 percent of people said they paid for a vacation by credit card when they didn’t have enough saved, with another 68 percent going over budget. The survey found that young travelers were the biggest culprits of racking up debt while traveling. "You don't want to come back with two weeks' worth of memories and two years' worth of debt," said Becky Frost, education manager for Experian Consumer Services. The most common sources of debt found in the study? Hotels and airfare, followed by dining and entertainment.