A new study by TD Ameritrade found that two-thirds of U.S. adults have experienced an event that seriously disrupted their long-term saving and retirement plans, most commonly losing a job, or having to accept a lower-paying job than they had previously. The respondents were saving an average of $530 a month before the event and just $240 after it, resulting in $16,240 lost savings over a period of less than five years. This adds up, the researchers tell us, to a net loss of $2.5 trillion for the U.S. economy.

Women overwhelmingly want to learn more about financial planning and be more involved with their finances, but less than half say they are confident talking about money and investments, according to a new report from Fidelity. The study echoes data shown by Eileen O’Connor at the TD Ameritrade National LINC conference, who argued that advisors need to shed their gender biases towards wealthy women and take an active role in helping them understand financial plans if they want to tap into a nearly $12 trillion market that is vastly underserved. At the same time, advisors can’t condescend and patronize women, according to Sally Krawcheck, who told attendees at the IMCA New York Consultants Conference to stop “mansplaining” to their clients.

A Lake Worth, Fla., financial planner faces anywhere between 34 months and 45 years in jail after being convicted of committing $1.3 million in fraud, the Palm Beach Post reports. Michael Hardman, 63, will be sentenced in April for stealing the money from a group of investors who gave him the funds to invest in a company named "Tech Support Systems." The investments were purported to be loans, which Hardman did make some interest payments on before stopping. "He ran this scam for a long time, and it was time he got caught," Assistant Florida State Attorney Kathryn Lewis-Perrin said.

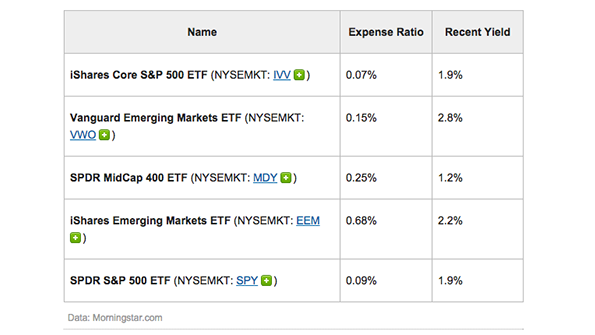

The top wealth managers handle billions of dollars in assets. But how they are managing that money isn't much of a secret. The Motley Fool did some analysis of Forbes' list of the top 50 wealth managers and determined that nearly half of them parked assets in ETFs. See above for the top five ETFs used by the top wealth managers.