This report is one of a series on the adjustments we make to convert GAAP data to economic earnings. This report focuses on an adjustment we make to convert the reported balance sheet assets into invested capital.

Reported assets don’t tell the whole story of the capital invested in a business. Accounting rulesprovide numerous loopholes that companies can exploit to hide balance sheet issues and obscure the true amount of capital invested in a business.

Converting GAAP data into economic earnings should be part of every investor’s diligence process. Performing detailed analysis of footnotes and the MD&A is part of fulfilling fiduciary responsibilities.

We’ve performed unrivalled due diligence on 5,500 10-Ks every year for the past decade.

The net funded status of a company’s pension and post-retirement plans is included on the balance sheet. When a company has underfunded plans, we do not make any adjustment. The company is making a choice to fund other projects rather than use its money to fund its pension plan. Effectively, the company is borrowing from its own employees.

When a company’s pension plans are overfunded, on the other hand, the excess assets are not being actively used to create revenue. Overfunded pension assets are similar to excess cash, and should not be included in the calculation of return on invested capital (ROIC).

JP Morgan (JPM) has over $17.9 billion in assets funding its pension and postretirement benefit plans, but only has $15.7 billion in obligations for those plans. The remaining $2.2 billion recorded on their balance sheet is removed from our calculation of invested capital and ROIC. For JPM, which has over $2.3 trillion in assets, that $2.2 billion has little effect on the overall investment outlook for the company. In other cases, however, the removal of pension assets can significantly alter a company’s ROIC.

Without careful research, investors would never know that total assets could include a significant portion of non-operating capital due to overfunded pensions.

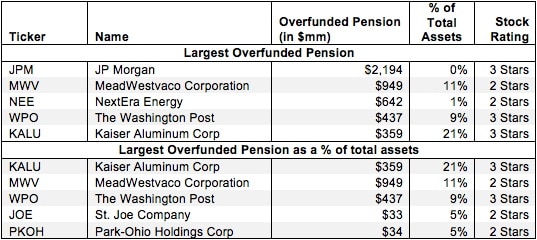

Figure 1 shows the five companies with the largest overfunded pensions removed from invested capital in 2012 and the five companies with the larges adjustment as a percent of total assets.

Figure 1: Companies With the Largest Overfunded Pensions Removed From Invested Capital

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

Relatively few companies currently have overfunded pensions. The majority chase short-term results by allocating their assets elsewhere and allowing their pension plans to remain significantly underfunded.

In 2012, we found 50 companies with pension and postretirement benefit plans overfunded by a combined $5.5 billion. Going back to 1996, we found 1,876 instances of overfunded pensions totaling $458 billion.

Since removing overfunded pension assets decreases invested capital, The ROIC of companies with significantly overfunded pensions may get a boost when we remove those assets from Invested capital. For instance, Kaiser Aluminum Corp’s (KALU) pension and postretirement benefit plans are overfunded by $359 million. Without removing this amount from invested capital, KALU would have had an ROIC of around 6%. After adjusting the $359 million out of invested capital, however, KALU has an ROIC of 8%. While that may not seem like a massive change, it could easily be the difference between a company making negative or positive economic earnings.

Investors who ignore overfunded pensions are holding companies accountable for capital that is not actively involved in generating returns. By removing overfunded pension assets, one can get a truer picture of the value that management is creating for shareholders. Diligence pays.

Sam McBride contributed to this report.

Disclosure: David Trainer and Sam McBride receive no compensation to write about any specific stock, sector, or theme.