For the last couple years, we’ve been inundated by headlines of the proliferation and growth of exchange trades funds. As of the end of October, total ETF assets were at $1.07 trillion, up from $699.8 billion in October 2009, according to the National Stock Exchange. There are now 1,137 ETF products on the market, and growing. This has caused a fierce competition for market share, bringing prices down.

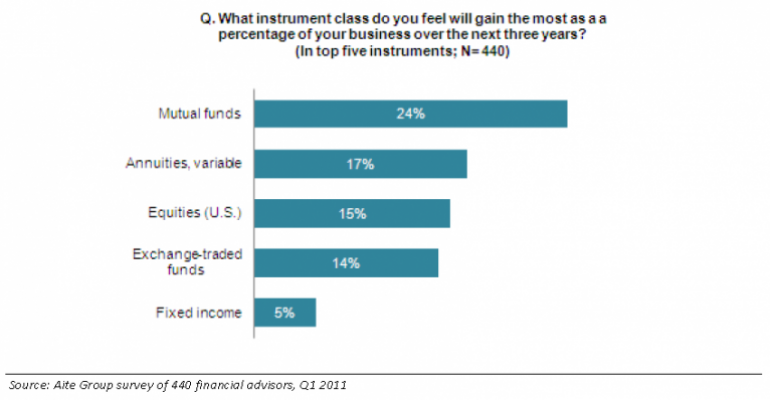

But for financial advisors, exchange traded funds haven’t yet unseated mutual funds, as many thought they would. A new Aite Group report found that mutual funds continue to dominate advisors’ books of business, representing 25 percent of advisors’ AUM. On average, ETFs make up 8 percent of advisors’ AUM, the survey of 440 FAs found. In fact, 24 percent of advisors expect mutual funds to gain the most asset share of their business over the next three years, while only 14 percent expect ETFs to gain the most.

The reason? Alois Pirker, Aite Group analyst, said the underlying issue could very well be the fee structure of mutual funds that benefits the advisor. It’s true—most ETF providers do not pay advisors trailing commissions, something that could keep advisors away. RIAs, interestingly, were more open to the investment vehicle, placing ETFs as the third most popular instrument by percentage of client assets invested. Fee-based RIAs are not relying on that kickback from mutual funds as part of their income, so they’re much more nimble and can fine-tune their business model to what the client is asking. “They are relying on their fee,” Pirker said.

Pirker, who was surprised at the findings, said the dominance of mutual funds could also be habit-based. Advisors are familiar with the mutual fund fee arrangements and how to build them into their practice. Mutual fund providers do a lot of wholesaling and training, and many services get packaged in with distribution. These companies have very established, active distribution arms, and they’ve been doing it for years.

That said, I don’t think the ETF trend is slowing down. One RIA I spoke to a couple weeks ago said mutual funds are out-of-date and antiquated. Pirker believes long term, there will be a bifurcation between more tracking-type products like ETFs and very active strategies that are performance-based, such as hedge funds. Other expensive active products, such as mutual funds, will be stuck somewhere in the middle, where it will hard to show that these can add value above passive products.