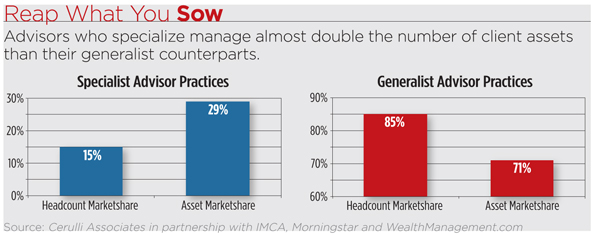

For advisors who want more business, it may be as easy as limiting their services. Sounds like conflicting advice, but recent Cerulli Associates research shows that advisors who specialize manage nearly double the number of assets per advisor compared to general advisors.

“Although practiced by a minority, specialization helps generate gains in asset aggregation,” says Cerulli director Scott Smith. “Specificity in marketing and in personal interactions throughout the business development process yields results that differentiate from generalist practices.”

Despite limiting an advisor’s potential client pool, specializing in a single niche such as retirement plans or high-net-worth investors increases an advisor’s success rate. According to Cerulli, only 15 percent of advisors focus their practices on specific areas, but they managed 29 percent of overall advisor assets as of June 2013.

According to Cerulli, advisors who keep a narrow focus on a particular demographic or client type are far better at convincing those clients they bring “incremental value” to the relationship. They have a deeper understanding of the client’s situation or

pain points. That focus also helps them win new business when competing against generalists.

“Asset managers can increase the value of their relationships by catering to the unique needs of specialized practices, such as providing guidance on requests for proposal to institutional advisors or providing customized product solutions,” Smith says.