NextCapital is making retirement planning the focus of its enterprise digital advice software with a major upgrade to its 401(k) platform.

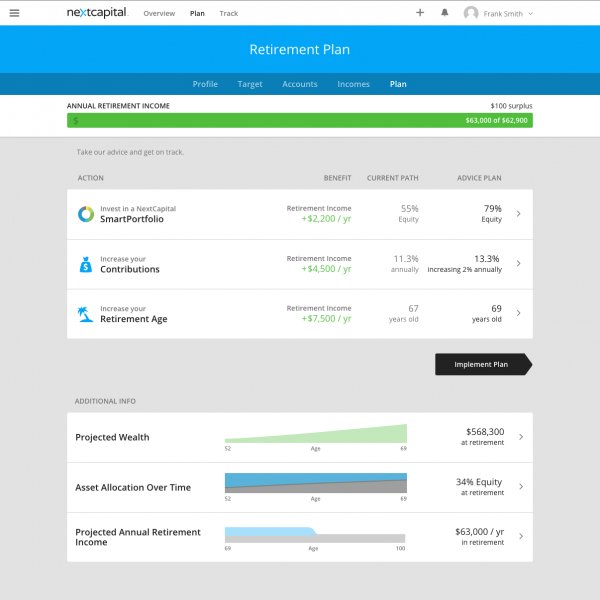

With new portfolio tracking and account aggregation features, NextCapital's 401(k) Digital Advice Platform creates personalized plans for each participant, including custom savings rates, portfolio recommendations, wealth and spend-down forecasts, and Social Security projections. Portfolios will all be automatically implemented, monitored and rebalanced through NextCapital’s connectivity with record keepers.

The company also updated the user experience on its client dashboard. Participants can now see their entire financial picture in once place with key performance, risk, asset allocation and forecasting metrics.

“You can’t plan for retirement without seeing all of your accounts, and the 401(k) is the primary place where 88 million Americans save for retirement,” NextCapital CEO John Patterson said in a statement.

William Boland, the senior wealth management analyst at Aite Group, said the 401(k) market is in need of more personalized plans that account for savings advice and portfolio management, and that NextCapital’s existing technology makes them well-suited to provide it.

NextCapital is expanding connectivity with leading 401(k) record keeping systems, and institutional partners can implement their own investment models with the NextCapital's “OpenEngine” to quickly bring a full-stack digital retirement planning solution to market.

Earlier in September, Betterment, one of the so-called “robo-advisor firms,” announced a new focus on the 401(k) market by taking its algorithmic approach directly to plan sponsors. Rather than connect with record keepers, Betterment built its own system, which it said will help keep costs lower than other providers.

Rob Foregger, the co-founder of NextCapital, said the company is taking a different approach by partnering with the record keepers and incumbents in the 401(k) space that stand to lose the most market share by not adopting automated advice technology. NextCapital wants to focus on mid to large size plans through enterprise partners like Russell Investments, which will start using the new client portal next month.

When asked how much the product would cost, Foregger said it would be dependent on the advice charged by the enterprise partners.

"What I can tell you is that our objective is to provide a 401(k) advice offering that is significantly less than Financial Engines, and more importantly, cost competitive with the $800 billion defined contribution target date fund industry," Foregger said. "We want to enable our enterprise partners to be able to offer a personalized plan, savings advice and portfolio for a cost not far from a target-date fund."