To enhance its ability to analyze bond portfolios, Morningstar purchased InvestSoft technology, an analytics company that focuses on fixed-income securities and portfolios. InvestSoft’s main product is its BondPro Fixed-Income Calculation Engine, which provides more than 130 analytics calculations. Frannie Besztery, Morningstar’s head of data, said the purchase would help “create a more complete view of mutual fund and exchange-traded fund portfolios, providing investors with better transparency into bond funds." Morningstar said it would gradually integrate InvestSoft’s capabilities into its data processing systems and functionality. Terms of the deal were not disclosed.

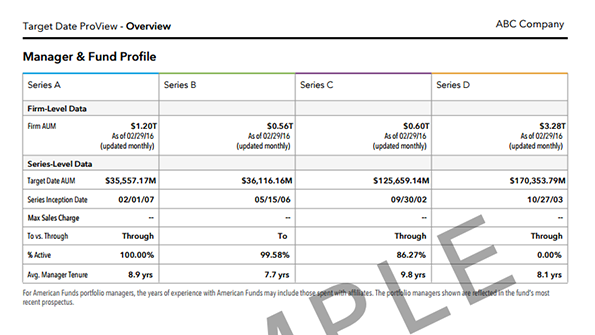

Target-Date Fund Evaluation From American Funds

American Funds has launched a new tool to help advisors and retirement plan sponsors evaluate target-date funds. The new Target Date ProView is aimed at helping plan fiduciaries follow Department of Labor guidance that came out in 2013. The guidance suggested having a process for comparing and selecting target-date funds, understanding the fund’s investments, reviewing the fund’s fees, establishing a process for periodic review and documenting the process. The new tool, powered by Morningstar data, focuses on common factors such as glide path, returns, risk, expenses, and manager and fund profiles.

If retirees could do it all over again, there are a few things they'd change, according to the results of a Pentegra Retirement Services survey. Walter Updegrave, editor of RealDealRetirement.com, says there are three main ways they would've saved differently: They would have started saving sooner; they would have saved more during their careers; and they would have paid more attention to retirement planning when they were younger. Writing on Money.com, he added that 26 percent of retirees suggested postponing taking Social Security as long as possible, and 22 percent recommended working with a financial advisor. "The sooner you start saving, the more you push yourself to sock away and the earlier in your career you make retirement planning a priority, the more secure and rewarding a post-career life you’re likely to have," he writes.