Investing successfully in art has always been a bit of a quagmire: opaque, inscrutable, unpredictable, ruled by passionate collectors and secretive insiders, a dangerous game for amateurs. And collectors and connoisseurs have long purchased art out of passion, but that may be changing, a new survey found.

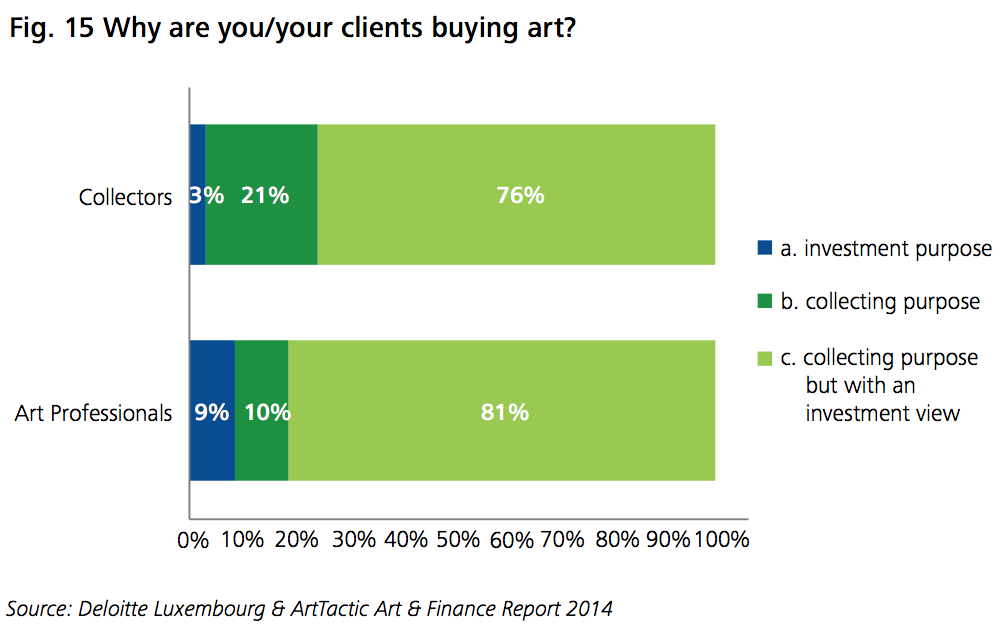

Seventy-six percent of collectors are buying art for collecting purposes, but with an investment view, up from 53 percent in 2012, according to a recent survey by Deloitte Luxembourg and ArtTactic. In addition, 81 percent of art professionals say clients are buying art for collecting purposes but with the investment tilt, up from 77 percent in 2012.

The Art & Finance Report 2014 surveyed 35 private banks, 14 family offices, 90 art collectors and 122 art professionals on their views of art and finance.

“We see significant opportunities for innovation and change, from the growth of art as a capital asset, to new sources of market liquidity, to growing demand for art banking,” said Roger Dassen, global managing director, clients, services and talent, Deloitte Touche Tohmatsu Limited, in a statement. “The world of art and finance will continue to converge for many years to come.”

The survey found that art is becoming increasingly important in wealth management, with 76 percent of art professionals and 62 percent of art professionals saying art and collectibles should be integrated into the wealth management offering.

But wealth managers are not quite as convinced, with 53 percent indicating there is a role for art in wealth management.

For one thing, performance has been poor. The Mei Moses World All Art Index posted negative performance from 2012 to 2013, but it returned 7 percent over the last 10 years, slightly below the S&P 500 total return of 7.4 percent.

Still, the report says there will be an increasing focus on art as wealth managers evolve their services for ultra-high-net-worth individuals. Art is one more way advisors can compete for those types of clients. Specifically, the report says wealth managers will focus on art and estate planning, art and philanthropy and art secured lending.