Millennials may strive for financial independence, but as a whole, they've been slow to break out on their own. According to Fidelity Investments' Millennial Money Study, nearly half (47 percent) of millennials still have their parents pay for certain items for them, namely cell phone plans, utilities, movie and TV streaming services and cable. That's not to mention the rising number of millennials who are living with their parents, now at 21 percent. The benefit of this? Millennials are learning to be more prudent with their finances, as 85 percent say they have some form of savings, up from 77 percent in 2014, and 59 percent have set aside an average of $9,100 in an emergency fund. Sixty percent also report saving for retirement, up from 51 percent in 2014. But while millennials are saving, they're still hesitant about investing. Of those with an emergency fund, 86 percent are storing it in a traditional savings account, where it's likely earning less than 0.25 percent in interest. In addition, only 9 percent of millennials view themselves as investors, compared to 44 percent who identify as spenders or 46 percent who consider themselves savers.

Tall and Average Weight Investors Take More Risks

Clients come in all shapes and sizes, and as an advisor, you probably don’t think much about their appearances. But a new study says this could provide insight into how they invest. A recent study by the University of Miami School of Business Administration found that people who are tall and normal weight are more willing to take risks and more likely to hold stocks than shorter, overweight or obese individuals. Specifically, an obese person (measured by body mass index) is 10 percent less likely to invest in stocks than a person of normal weight, while individuals in the top 20th percentile for height are 7.5 percent more likely to invest in stocks than the lowest 20th percentile. Why the difference? Confidence and optimism. Overweight individuals tend to be less optimistic and confident, the authors point out, and this could make them more risk averse. "We found that the environmental feedback one receives due to physical attributes shapes people and affects their portfolio decisions," said George Korniotis, associate professor of finance at the University of Miami School of Business Administration, who conducted the study.

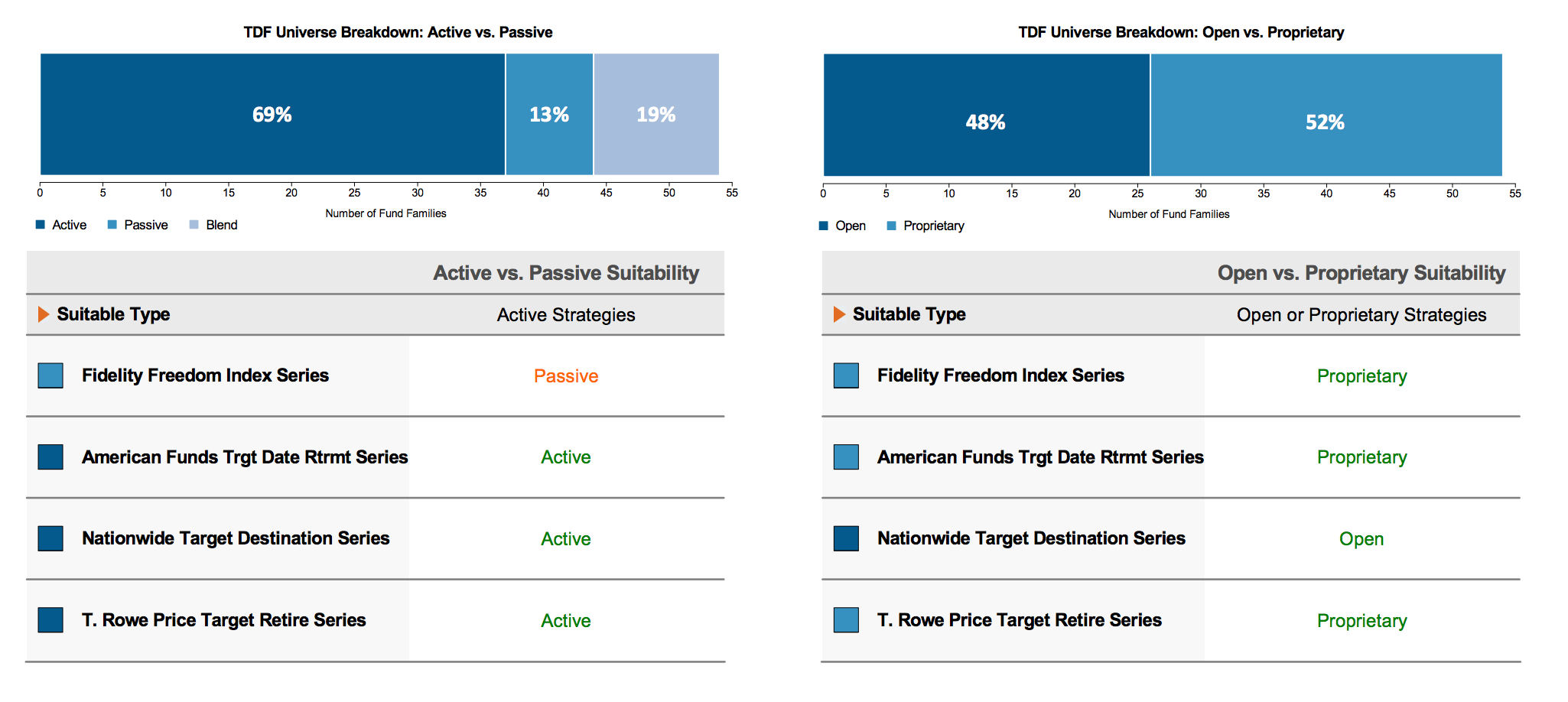

MPI Debuts New TDF Selection Tool

Markov Processes International (MPI), a fintech company focused on investment research and reporting, has developed a new tool to help fiduciaries search for and select target-date fund (TDF) families to match with a defined contribution plan’s demographics, behaviors and preferences. The “Target-Date Radar” was designed for the coming DOL rules and employs quantitative analysis, data visualization and detailed reporting for suitability comparisons. Target-Date Radar also gives advisors repeatable methodology for selecting TDFs and a documentation process. MPI said the tool goes beyond traditional glide path measurements to help manage longevity, volatility and inflation and allows users to shape their retirement plans according to their life stage. In a statement, Chas Mansfield, the CIO of Compass Financial Partners, said similar tools are designed by firms trying to guide plan sponsors to a certain fund family, which could be problematic in the post-DOL world. “[Target-Date Radar] has no hidden agenda, empowering the advisor, the plan and the participants.”