Two years ago, in our Annual Report, we correctly predicted that 2009 would be the year of print-and-spend; that gold prices would soar; that government response to mounting debt would increase currency risk; and that inflation, not deflation, was an issue because the U.S. Federal Reserve has an unlimited ability for currency creation. Over the past year, conditions have deteriorated as these events continued to play out, and once again precious metals prices were the beneficiaries.

Download the complete PDF of the Annual Review

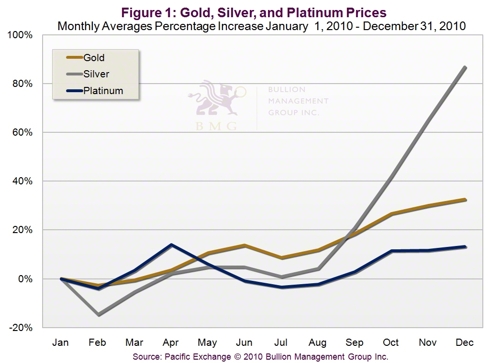

We predicted that silver would outperform in 2010 as investors rediscovered its role as a monetary metal alongside gold. As Figure 1 shows, silver not only outperformed, it rocketed higher, gaining 78 percent for the year to close at US $30.63 an ounce. While silver was catching up to gold, gold itself pushed higher for the tenth straight year, rising 28 percent to close the year at US $1,405 an ounce. Meanwhile, platinum ended 2010 at US $1,755, up a robust 17 percent thanks to a combination of industrial and investment demand.

The Global Economy Continues to Sputter

While precious metals prices were soaring, the debt-saturated global economy continued to struggle. Record government spending pushed government deficits ever higher, and a massive bailout was needed to prevent Greece, Ireland, Portugal, Spain and other members of the Eurozone from sinking under sovereign debt. But debt woes also threatened to spiral out of control in two of the world’s largest economies - the UK and Japan (a country that has been mired in a stock market recession for two decades). Although it never became headline news, 2010 was the year China leapfrogged past Japan to become the world's No. 2 economy and, based on its current growth rate, it will likely surpass the US as the world’s largest economy by 2020.

Faith in the Dollar Declines as US Debt Spirals Higher

Despite desperate attempts at “reflating” the economy through uncontrolled currency creation, US economic growth remained anemic in 2010 while government debt continued to explode. In 1971, when the US severed the last link with gold, US public debt totaled only $776 billion. Today, it exceeds $14 trillion, more than America’s entire GDP, and debt payments account for 43 cents of every dollar of US government spending. In 2010, President Obama and the US Congress agreed to keep the Bush tax cuts instead of rolling them back. This decision, combined with high unemployment and bankrupt state governments, means tax revenues will be lower and borrowing requirements will be higher.

US debt of $14 trillion is an almost unimaginable number, equaling $128,391 per taxpayer. But if unfunded obligations for Medicare and Medicaid are added, US government liabilities top $113 trillion, or a staggering $1 million of debt for every taxpayer. Economists such as Professor Laurence Kotlikoff of Boston University have estimated the debt to be as high as $200 trillion.

Never Let a Good Crisis Go to Waste

More than two years after the fact, the cause of the 2008 financial crisis has still not been addressed, not a single US banking official or Wall Street executive has been criminally charged, unemployment remains at decades-high levels, the banking sector remains broken and nearly one in four American homeowners owe more on their mortgages than their homes are worth. And, despite the pain, real banking reform has not occurred.

In 2010, total compensation at publicly traded Wall Street banks and securities firms soared to a record-high $135 billion. The Dodd-Frank financial reform act was passed, but was watered down thanks to intense lobbying by the banking industry. As The Economist aptly put it, “It takes thick rose-tinted glasses to accept President Obama’s assertion that the new law will ensure an end to bank bail-outs.” President Obama’s former economic advisor Larry Summers was outraged at the extent of the lobbying, going so far as to scold the banks for spending on average $1 million per member of Congress (approximately half a billion dollars) to lobby against the bill.

U.S. Stock Markets Ride a Wave of Quantitative Easing

Throughout most of 2010, US stock and bond markets were oblivious to the economic misery. By year-end, the Dow had gained 11 percent; the S&P 500 had gained 12.8 percent, and the NASDAQ had gained 17 percent. This was no coincidence. A prominent hedge fund Greenlight Capital explained in its year end letter to clients: “On August 27, 2010, Federal Reserve Bank Chairman Ben Bernanke gave a speech in Jackson Hole, Wyoming where he hinted that the Fed would provide additional monetary easing. At the time, the S&P 500 was down more than 3 percent for the year. From that point through the end of the year, the S&P rallied 19 percent. At the same time, oil prices rose 16 percent, copper prices rose 32 percent, coffee prices rose 34 percent, corn prices rose 43 percent and cotton prices rose 57 percent.”

Canadians Sink Further Into Debt

Meanwhile, Canada’s resource heavy S&P/TSX Composite Index needed no direct monetary help. It gained 14 percent in 2010 to close the year above 13,000, or nearly 70 percent higher than its mid-crisis low of $7,724.76 made on November 20, 2008. Canada’s banking system may have escaped the financial crisis unscathed, but unemployment is high, and Canada’s consumers continue to sink into debt. This is despite warnings from the authorities, including Bank of Canada Governor Mark Carney, who cautioned Canadians about their debt loads more than a year ago. It seems few listened.

According to Statistics Canada, Canadian household debt reached a record 148 percent of disposable income in 2010, topping US levels for the first time in over a decade. In the third quarter of 2010, consumer debt increased by 1.3 percent while incomes fell by 1.5 percent. An increase in Canada’s artificially low interest rates will wreak havoc with Canadians’ finances.

QE2 and the Decline of the Dollar

Buoyed by QE2 (phase 2 of the US Federal Reserve’s quantitative easing program), interest rates remained low, allowing stock prices to remain historically expensive on a price-to-earnings basis.

In recent (February 9, 2011) testimony before the Committee on the Budget, US House of Representatives, Fed Chairman Ben Bernanke defended quantitative easing by saying that the Fed's purchases of longer-term securities (bonds) via quantitative easing “are not comparable to ordinary government spending [because] the Federal Reserve acquires financial assets, not goods and services; thus, these purchases do not add to the government's deficit or debt.” Whether more debt is ultimately created or not is debatable. What is not debatable is this: when a central bank engages in quantitative easing, it simply credits its own bank account with money it creates electronically. In other words, the bank creates dollars out of thin air.

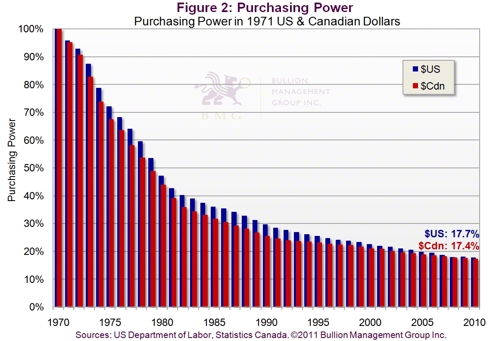

Excess currency creation debases the dollar, and thus debases the wealth of every investor who holds dollar-denominated financial assets (stocks and bonds) in their portfolio. In other words, most North American investors. The decline in the dollar’s purchasing power is remarkable. Please see Figure 2 for a 40-year chart of the decline in the US and Canadian dollars since 1971 – not coincidentally the year world currencies de-linked from the gold standard.

Investors Flock to Precious Metals

The continued rise in price of gold, silver and platinum is clear evidence that confidence in currency-based assets is on the wane. Silver has rallied more than fourfold since 2008, while gold has more than doubled. Wealth preservation remains paramount because the global economy is extremely fragile; the banking system remains on life support and governments are engaged in competitive devaluations through excessive currency creation. Because astute investors are always ahead of the curve, they are diversifying into precious metals bullion − real wealth that cannot be created in unlimited amounts by government decree.