Another insurance company is buying a financial services technology startup.

John Hancock announced Tuesday that it acquired Guide Financial, a San Francisco-based company that creates automated financial planning tools, for an undisclosed amount.

While not a “robo-advisor” that automatically allocates assets, Guide says it applies “artificial intelligence to help investors make better planning decisions and build wealth.”

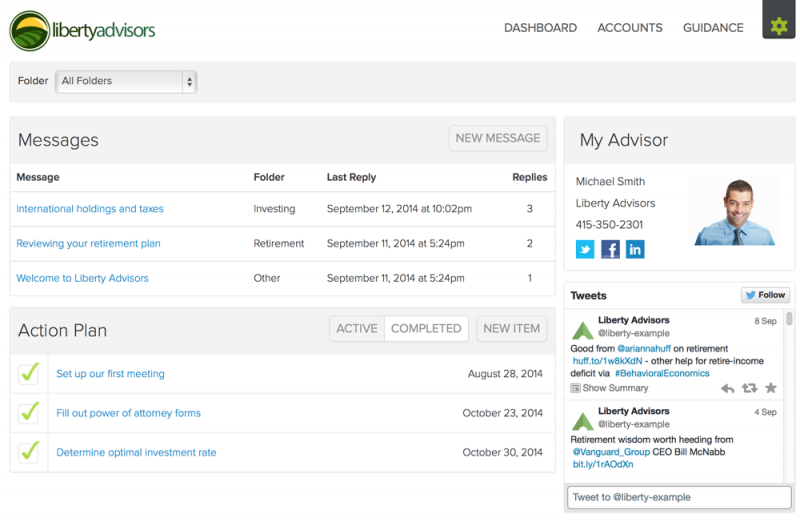

Through a partnership with Intuit, Guide connects with 19,000 financial institutions to aggregate a client’s various accounts and financial information into a single digital portal. A financial planning engine analyzes the data and uses algorithms to help advisors with cash flow and funding decisions, optimize deferral rates, and suggest investment behaviors. Advisors can message clients through the portal and set Guide to push automatic notifications to keep clients on track with their plan.

Guide costs advisors a monthly fee of $50 for an unlimited amount of clients.

It’s unclear if the acquisition by John Hancock will affect pricing, how the firm’s advisors will incorporate Guide into their practices, or if independent advisors currently using Guide will have to sell John Hancock products. A John Hancock representative said the company would not discuss specifics beyond a press release, “due to the proprietary nature of the deal.”

Guide Financial will continue to operate in its San Francisco office as an independent group, with its employees reporting to Tim Ramza, senior vice president of wealth business development and strategy at John Hancock. Uri Pomerantz, Guide Financial’s co-founder and CEO, said the behavioral finance concepts and technology will “integrate” with John Hancock’s products and services.

Joel Bruckenstein, a financial technology analyst and founder of the Technology Tools for Today conferences, said that Guide’s focus on cash flow and retirement advice could have been what swayed John Hancock.

"When someone reaches retirement, cash flow is something they care about," Bruckenstein said. "It could be that they just thought it was a good fit based on their business model."

John Hancock is the latest large institution to get into the financial services technology business. Fidelity purchased eMoney in February, and Northwestern Mutual followed in March with its acquisition of LearnVest.

The trend could be driven by asset compression forcing insurance companies and asset managers to expand their product line and get into new business, Bruckenstein said. They may have chosen to acquire because the opportunity costs are too great to take the time necessary to build an in-house solution.

"They're deciding that expediency wins out and they need to be there sooner than later," Bruckenstein said. "Ultimately, it's very hard to draw any conclusions rapidly about how successful this kind of acquisition is going to be."