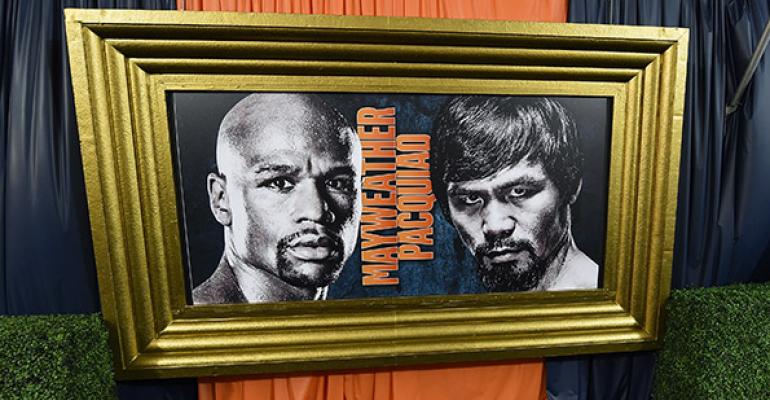

P Diddy may be backing Floyd Mayweather over Manny Pacquiao, but the Internal Revenue Services will likely be the real winner of the expected heavy gambling on Saturday’s fight in Las Vegas.

Bookmakers are predicting brisk betting on this weekend’s fight, perhaps even enough to topple the current $119 million record for the bets placed on the 2014 Super Bowl. But even outside the Las Vegas casinos, people are getting into the spirit. Last week P Diddy bet actor Mark Wahlberg $250,000 that Mayweather would take the night.

But it’s important to keep in mind that any winnings will be taxable, says Alan S. Kufeld, a partner with New York-based Flynn Family Office.

For those fortunate enough to win larger pots on this weekend’s fight, the winnings are taxable at personal income rates, though gamblers can deduct losses if they itemize their returns. Often, the casino will automatically withhold 25 percent of the winning pot and report the winnings to the IRS, Kufeld says. Gambling income includes – but is not limited to – winnings from lotteries, raffles, horse and dog races and casinos, as well as the fair market value of prizes such as cars, houses, trips or other noncash prizes.

According to the IRS, when a non-professional gambler pockets $600 or more (and that amount is 300 times the bet) at a horse track, or wins $1,200 at a slot machine or bingo game, or takes $1,500-plus in keno winnings, they must give their Social Security number to the casino or facility and let the IRS know about the extra income. The IRS also requires all poker tournament sponsors to report competitors' winnings of more than $5,000.

But even for those who are betting for smaller stakes between friends or family, those winnings are still taxable, Kufeld says. Even if there’s no official record of the bet, the full amount of all gambling winnings for the year must be reported on line 21 of IRS Form 1040. “We always caution our clients to do the right thing,” he says. And in some cases, particularly in regards to social media, there may be a public record of the bet that can be looked up later,” he added.

So what does that mean for Uncle Sam? If the predicted $119 million moves from losers to winners after the fight, and not counting the casino's vig, the government could hypothetically collect as much as $50 million, assuming every single gambler was in the top tax bracket (and no one on the losing side of the bet offset other winnings in their itemized deductions.)

“It’s very important to keep good records on where you’re doing the gambling, what state it’s going to take place in, any expenses you might have to offset that,” Kufeld says.

Kufeld also cautions that while donating your winnings to charity is nice, don’t think it will wipe out your tax burden. “The tax liability is not going to wash, it’s not going to be zero,” he says, adding that charitable donations have some itemized deduction limitations associated with it. “There are probably more effective ways of structuring it.”