We’ve all heard this song and dance before; already the financial media is in a frenzy over the positive asset flows into stock funds in 2013. For the week ending Jan. 9, investors poured $7.53 billion into equity funds, and another $3.75 billion for the week ending Jan. 16. But I’m not convinced that investor behavior will change that drastically and overnight.

Retail investors are notoriously stupid. Just look at how they’ve behaved in the last five years, via Morningstar:

Even when exchange-traded fund flows are included, large-cap U.S.-stock funds have seen net outflows over the trailing five-year period and in each of the past four years. Meanwhile, the S&P 500’s cumulative return over the five-year period is a respectable 8.59%. Investors haven’t just sat out the uneven stock market rally that began in March 2009; they have run from it and never looked back.

And 2012 was even the worst offender. According to Morningstar, investors yanked $120 billion from U.S. stock funds in 2012, surpassing outflows seen in 2008. And the S&P 500 was up 16 percent for the year!

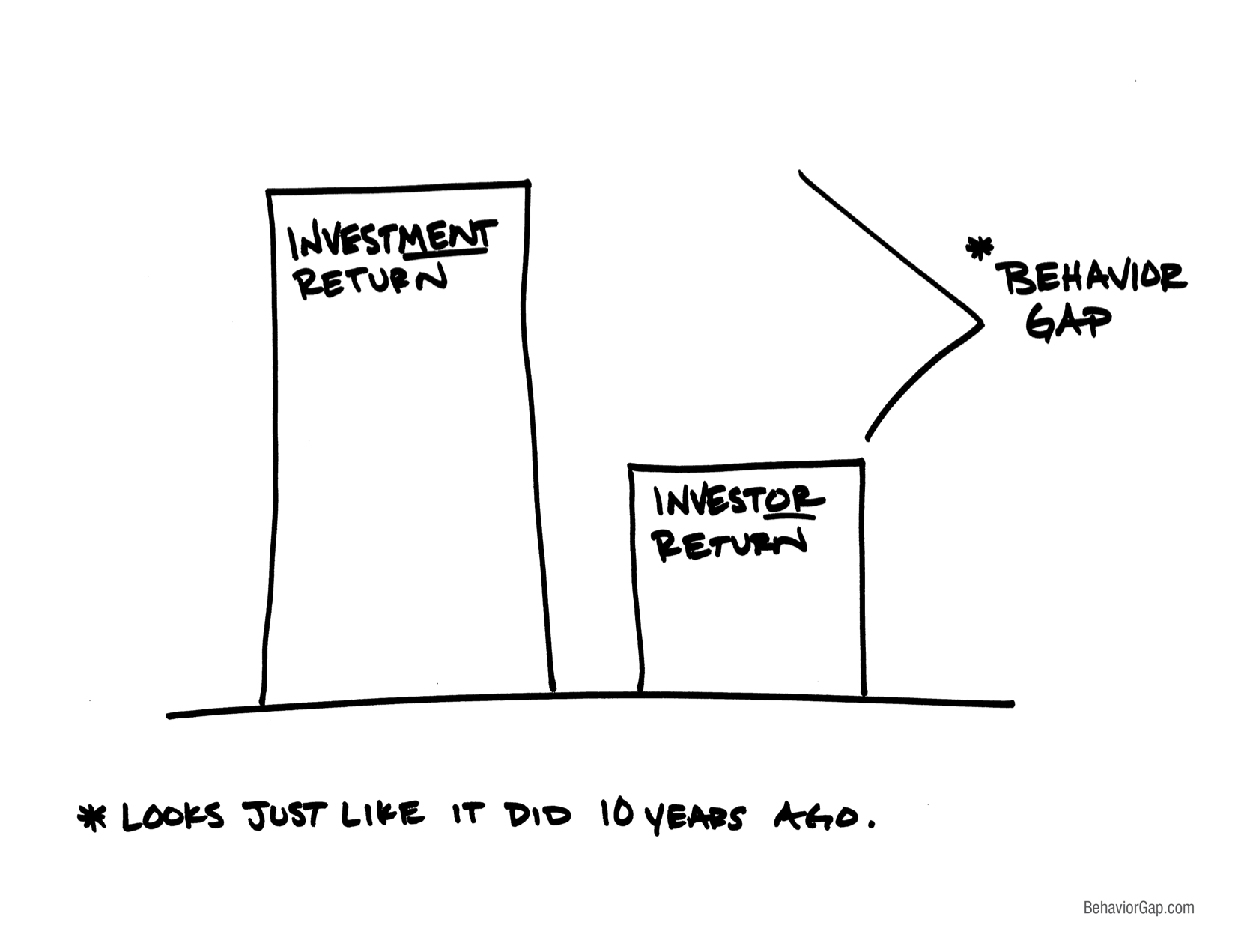

Carl Richards, director of investor education for BAM Advisor Services and author of The Behavior Gap, says investors are going to continue to make the same mistakes. That was the inspiration behind one of Richards’ first drawings and his book. “The Behavior Gap,” is the difference between how investors behave (investor return) and how the markets actually perform (investment return). I agree with Richards that this gap is not going away, at least not anytime soon.

“That difference between how we feel about things and how things are in reality when it comes to our investments is often really problematic,” Richards said.

But you, Mr. Advisor, may be responsible (partly). “It’s like the third rail; none of us talk about it,” Richards said.

According to the Investment Company Institute, 80 percent of mutual fund shares owned outside of retirement plans at work are advisor-directed.

“If the bulk of the money in mutual funds, is advisor-directed, and the studies on the ‘behavior gap’ are based on mutual funds, it doesn’t take a genius to make the next step and say, ‘Advisors are to some degree part of the problem,’” Richards said.