PricewaterhouseCoopers predicts major changes coming to the financial services industry by 2020, especially in the makeup of a firm’s workforce and how it is recruited, organized and compensated. With automation replacing the bulk of transactional tasks, financial services firms need to rethink job roles and responsibilities to adapt. The consulting firm lays out seven priorities, starting with a need to build "trust and purpose" into the employer brand. The report also recommends firms modernize their on-the-job training to more easily adapt to changing technology, "digitize the workforce" (i.e., replace humans with computers) where it makes sense to increase productivity, better integrate data analytics into business decisions, and redesign compensation models.

Investors Want Health Factored Into Financial Plans

As people live longer and health care costs rise, investors want their financial advisors to factor in their health when building financial plans, according to new research by Transamerica and independent firm Luntz Global Partners. The research was based on focus groups as well as a 2016 survey of 1,000 adults in the U.S. with investable assets of $50,000 or more. Eighty-one percent of respondents said it would be “very” or “extremely” valuable for a financial advisor to consider their health and potential health care expenses when building their financial strategy. Respondents also said health was the most essential to their financial future, at 37 percent, followed by happiness (19 percent), security (19 percent), peace of mind (16 percent) and independence (9 percent).

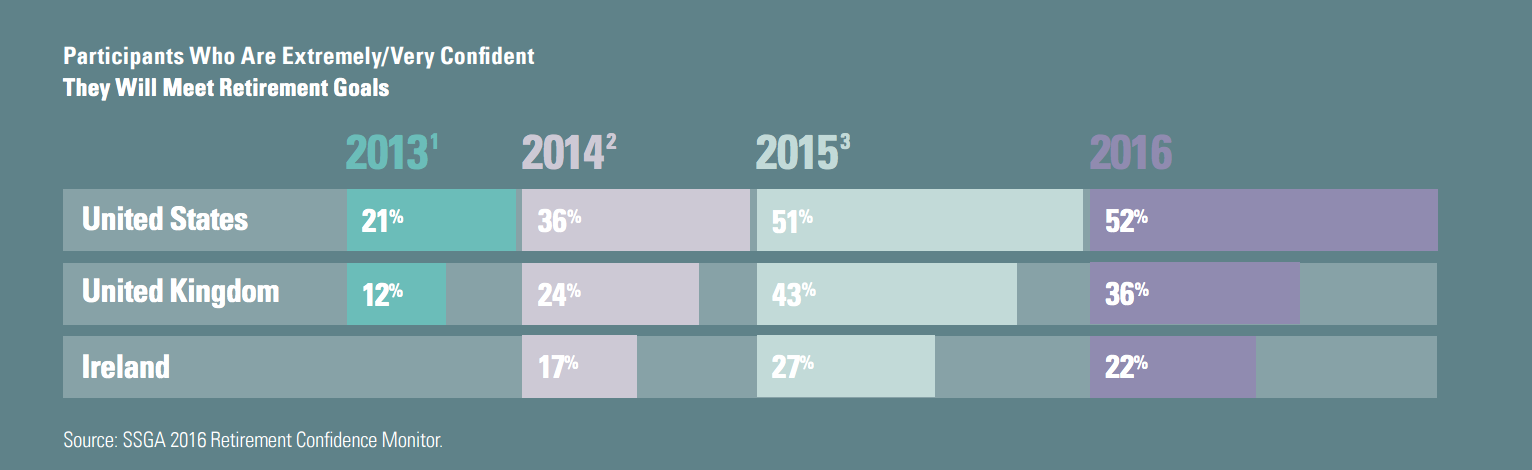

How the U.S. Stacks Up in Retirement Confidence

Americans feel more confident about meeting their retirement goals compared to citizens of Ireland and the United Kingdom, says State Street Global Advisors's Retirement Confidence Monitor 2016. More than half of U.S. respondents say they are on track in saving for retirement, while only 22 percent of Irish and 36 percent of UK respondents say they feel the same way. Now in its fourth year, the study included a "financial wellness index," which shows that, generally, the United States scores higher in this area as well. But, the majority of respondents from all three countries feel more confidently about attaining their retirement goals, feel more financially stable and are satisfied with workplace plans. And that's a good thing. “Employers should view increased satisfaction and stronger financial stability as a sign that retirement readiness is improving,” said Fredrik Axsater, global head of State Street Global Advisors Defined Contribution. “Bringing financial wellness indicators into the picture can help employers focus on additional worries, such as debt management or emergency savings, that may be impacting how employees feel about and prepare for retirement."