Many blamed the financial services industry for the financial crisis of 2008 and 2009. But according to a new index, the financial services sector is in better shape than before the crisis and is poised to support the recovery.

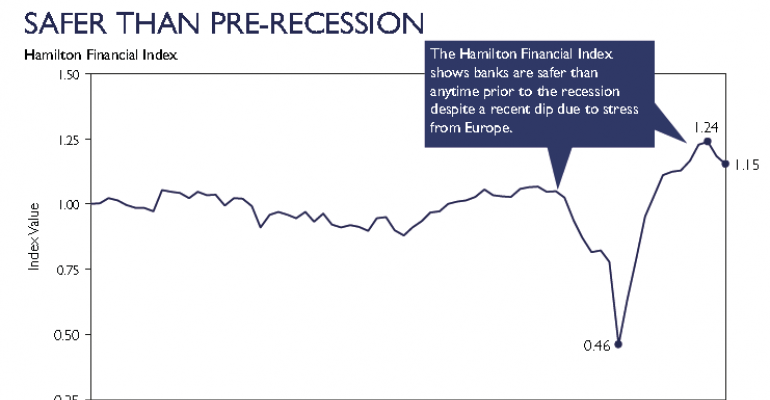

On behalf of the Partnership for a Secure Financial Future, Hamilton Place Strategies has launched the Hamilton Financial Index, which is meant to measure both systemic risk and capital levels of financial services firms. According to a report released Tuesday, the index was at 1.15 as of the fourth quarter 2011, 15 percent higher than the historical norm. At the end of 2007, the index hovered just around 1.

The index is measured using the St. Louis Federal Reserve Financial Stress Index, which captures 18 market indicators. It also takes data from the Tier 1 Common Capital Ratio, which measures financial institutions’ ability to absorb unexpected losses in an adverse environment:

To get the index value, we simply subtract the quarterly average of the Financial Stress Index from the quarterly Tier 1 Common Capital Ratio for the commercial banking industry. In order to index the values, we used the first time-series data point, the first quarter of 1994, as the divisor for all periods. This set the first data point equal to one. Therefore, all data points are relative to the value of one. The value of one also happens to be the average of all time periods from the first quarter of 1994 to the fourth quarter of 2011. Observed values around one are consistent with the historical norm of a safe financial industry.

The report also says that commercial banks have reduced their holdings of risk-weighted assets by 11 percent since 2007. It all translates to a safer and sounder financial services industry, as Hamilton says:

Unlike prior to the crisis, current capital levels are at an all-time high and stress has been reduced, although not completely. The St. Louis Federal Reserve Stress Index showed higher levels of stress during the debt ceiling negotiations and the European crisis. These events caused the Hamilton Financial Index value to drop, despite high capital levels in recent quarters. If market stress subsides, we expect the index to increase back toward all-time highs.The Hamilton Financial Index weighs both the level of risk in the financial system and the amount of capital financial institutions hold to deal with that risk. Importantly, it shows that financial institutions are in a better position today than they were even in the years prior to the crisis.

But I’ve got to take such new indexes with a grain of salt. Yes, I believe financial institutions are in a better place and have learned important lessons from the financial crisis. Bonuses have been reduced, and cost-cutting is the norm. Analysts would say that balance sheets are stronger, and companies have taken steps to increase the amount of cash they’re holding.

But look at the organizations that make up The Partnership for a Secure Financial Future: Consumer Bankers Association, Mortgage Bankers Association, Financial Services Institute, and The Financial Services Roundtable. They are financial services trade and advocacy groups that of course want the industry to build a positive image. When an industry says, "Everything is OK; in fact, it's better than we thought," I've got to stop and question it. Read the report, and make a judgment for yourself. There's definitely some good data in this report, and it sounds good to hear. But like I said, the index is still new and yet to be tested.