Desperate times call for desperate measures. So complicated market environments call for complex investment strategies, right? At least that’s what investors (and asset managers) are hardwired to think, according to the latest piece from Jason Hsu and John West at Research Affiliates. But their research shows that simple, low-turnover strategies have similar returns, before fees, to complex, high-turnover strategies, which have higher fees. “The globally integrated investment markets and economies are anything but simple, so it would not at first appear that a simple strategy could carry the day,” Hsu and West write. But they do. In fact, they also discourage investors from overreacting to short-term noise. Unfortunately, many advisors compound the issue, they write. “Advisors or consultants hired to help investors make sense of the noise in the market, and to find the skilled managers, are also incented by the complex,” they write. “Charging a respectable fee for a manager selection process that puts the client into a simple, straightforward strategy is not so easily justified to the client.”

The U.S. markets are finally catching up to the rest of the world and are now in the process of repricing, writes Nir Kaissar for Bloomberg Gadfly, adding that this is not the beginning of a financial crisis 2.0. He writes that the global economy has been showing signs of turmoil for much of the last two years. To think that the United States would remain an "island of prosperity" was just fantasy. Instead the U.S. markets have woken up to reality and are now adjusting to find more appropriate levels of price, just as the rest of the world has. And while a systematic failure like the one that occurred in 2008 is not out of the question, what is happening now is not only long overdue but in fact perfectly healthy for the national economy.

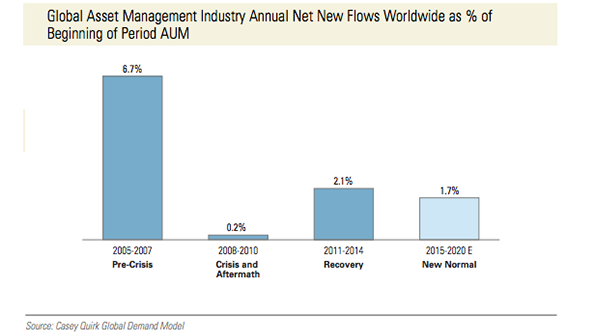

On the whole, asset managers struggled to bring in new assets last year, with global net flows in 2015 dropping to 1.6 percent from 2.6 percent in 2014. And consultant Casey Quirk estimates they will remain muted over the next five years, averaging 1.7 percent from 2015 through 2020. The consultant also found that global assets under management fell 2.4 percent and revenue slid 2.9 percent. Median operating margins fell back 32 percent in 2015, down 2 percentage points from 2014. “2015 is in fact emblematic of the ‘new normal’ we see emerging in the industry,” Jeffrey Levi, partner at Casey Quirk and head of the firm’s Knowledge Center, said in a statement. The report also noted that passively managed funds haves continued to grow in popularity among individual investors. Passive funds now represent 19 percent of the total global asset management market, compared to 11 percent in 2009. Casey Quirk estimates net flows into passive investments totaled $747 billion in 2015, more than double the $312 billion of net money into active strategies.

A Retirement Contrarian Says Income Goals Are Too High

According to a new book by Frederick Vettese, the chief actuary at Morneau Shepell, a human resources consulting and technology firm, most financial advisors recommend unrealistically high retirement income targets. Vettesse disputes the idea that retirement income should replace 70 to 80 percent of final pay and says hardly anyone (outside of the public sector, assuming pension funds stay healthy) can reach this. The result is unwarranted anxiety among savers, Vettesse concludes in The Essential Retirement Guide: A Contrarian’s Perspective. He says that 50 percent of pay is a better retirement goal. “One is tempted to wonder whether the overstatement stems from the fact that the financial services industry makes more money when people save more,” Vettesse said. “More likely though, it is a case of incomplete analysis coupled with the mistaken notion that one cannot go wrong by over-saving.”