Investors were net sellers of equities in July, according to TD Ameritrade’s Investor Movement Index. The broker/dealer subsidiary of TD Ameritrade Holding said the selling, as well as lower volatility in widely held names (like Apple, Facebook and Bank of America) contributed to an overall decline in exposure to equity markets in TD client accounts. Nicole Sherrod, the managing director of trading at TD Ameritrade, said July was typical when the market advances to new highs, as it’s continued to do recently. “Retail investors tend to take profits in stocks that have had significant moves to the upside and rotate into stocks that they find to be undervalued,” Sherrod added.

Who Isn't Worried About Saving for Retirement?

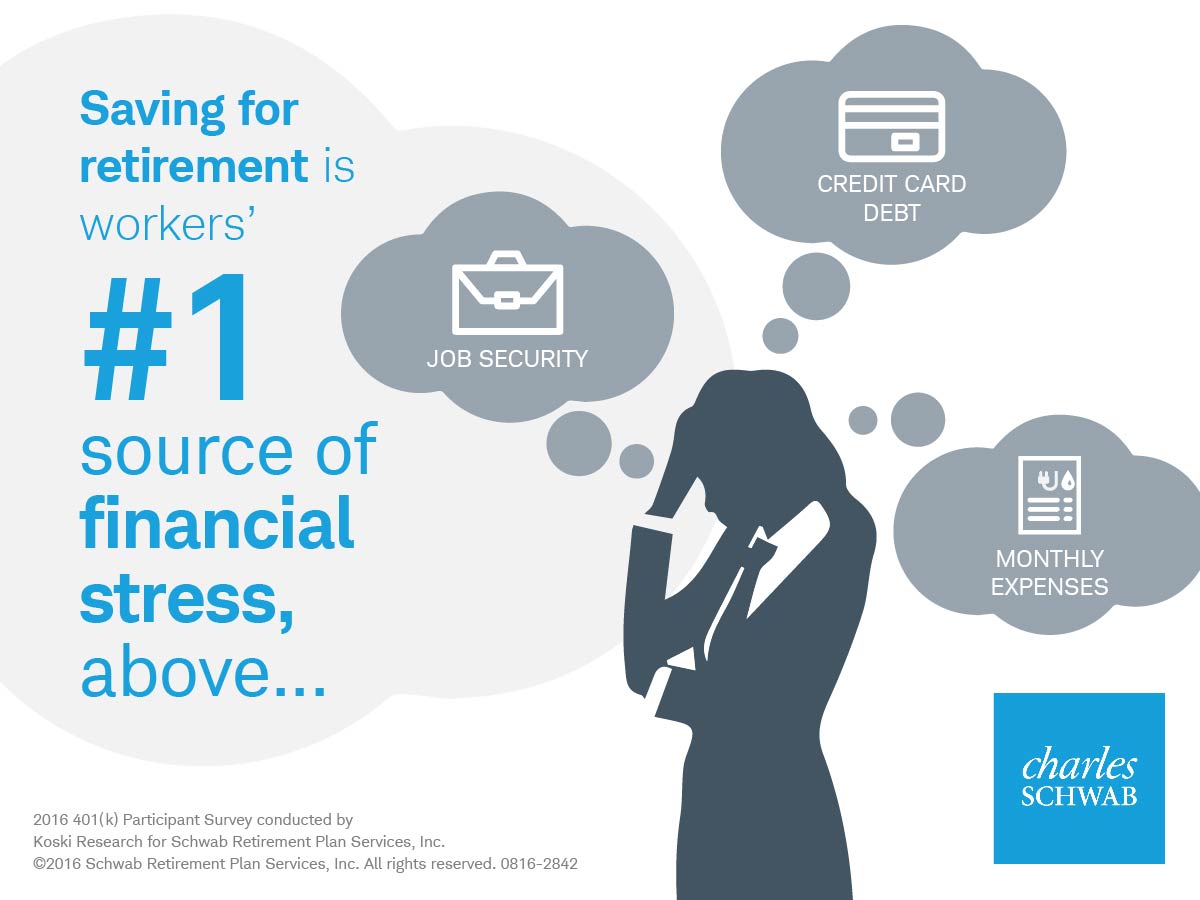

Saving enough money for retirement is the most prominent financial stressor for people of all ages, even millennials, according to a new survey from Schwab Retirement Plan Services, Inc. Thirty-eight percent of the younger generation cited saving for retirement as their main source of financial stress, above monthly expenses, credit card debt and student loan debt. And, that number isn't much different than the general population, 40 percent of whom cite saving for retirement as their number one financial stress inducer. This may be why 90 percent of the survey's 1,000 respondents—all 401(k) participants—feel that a 401(k) is a "must-have" benefit included in any job offer. “With so many competing obligations and priorities, it’s natural for people to worry about whether they’re saving enough for retirement,” said Steve Anderson, executive vice president, Schwab Retirement Plan Services. “Roughly nine out of ten respondents told us they are relying mostly on themselves to finance retirement. It’s encouraging to see people of all ages taking responsibility for their own future and making this a top priority.”

The Four Stages of HNW Families

A new paper by California-based Pillar Wealth Management details the four stages high net worth families encounter on their journey to stable affluence. The stages are accomplishment, in which families realize they can live however the want for the rest of the lives with no fear of financial obstacles or need to generate additional wealth; obligation, in which questions arise about securing wealth and the anxiety and fear that wealth can disappear quickly; establishing, when families reach out to experts for answers and advice; and purpose, which is when clients realize that wealth is not an end unto itself, but an opportunity to make a lasting impact. Advisors can help them by creating customized wealth management strategies, giving clients a clear understanding of what they own and what should be tweaked in the future, and providing information at clients' fingertips so they don't feel like they are on the outside looking in when it comes to protecting and managing their own wealth.