With the ascendance of robo advisors and algorithmic upstarts, many industry pundits argue that investment management and asset allocation has become commoditized. Advisors should, instead, focus on other areas of their practice where they can add value beyond investments, such as financial planning or hand-holding during volatile markets.

Of course, advisory practices focused on investment management are still thriving in this industry, but a new study indicates they are growing at a slower pace. Advisors who spend more of their time on asset gathering and retention activities tend to have higher AUM growth rates and revenue growth than those focused on investment management, according to a new study conducted by FP Transitions and published by SEI.

The study classified “investment managers” as those advisors who spend 10 percent or more of their time on investment research and 10 percent or more on portfolio rebalancing. “Client managers” are those who spend 5 percent or less of their time on these activities.

FP Transitions found a divergence between these two business models. On average, client managers spend 56 percent of their time on client relationship activities, such as client meetings, prospecting and marketing, whereas investment-focused advisors spent more time (37 percent) on investment-related activities compared to relationship building (30 percent).

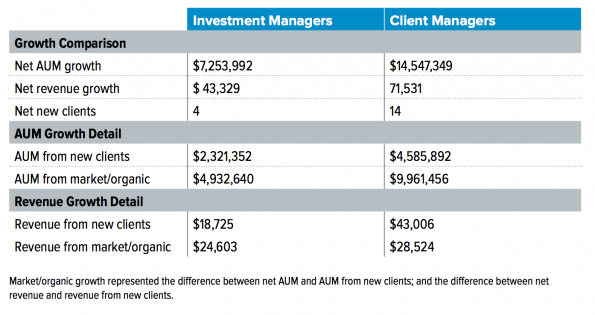

Client-focused advisors saw a growth rate in AUM of 18 percent, compared to 11 percent for investment managers. And on average, client managers added $14.5 million in assets per year, versus $7.2 million for the other group.

They also had higher revenue growth: Client manager advisors boosted their annual revenue by $71,000, compared to just over $43,000 for investment managers.

The firms focused on client-facing activities had more clients (285 versus 165), yet their clients tended to be smaller, with an average AUM per client at $322,000 versus $469,000 for the investment managers.

“We acknowledge that many advisors are content with the status quo and enjoy actively managing client investment portfolios,” the report said. “Many of these advisor/owners may have no interest in growing their practices or selling their firms. Understandably, they favor the notion of dealing with fewer clients whose account values are higher, on average. Key person–dependent firms seeking growth, however, will need to focus more on growing existing client assets, both in terms of enhancing portfolio performance and encouraging existing clients to add new money to their accounts.”