The Chronicle of Philanthropy reports that Australia’s richest person, the mining magnate Gina Rinehart, may contribute half of her estimated $10 billion fortune to charity under the terms of a proposed settlement agreement with her two adult children. The family struggles cover the usual topics of money and succession planning and were set off in 2011, when Gina attempted to strong-arm her children into delaying the vesting of a $3 billion family trust in their names. Strangely, both sides claim to have made leaving a large portion of the estate to charity central to their respective negotiating positions. Though this story reeks of “If I can’t have it no one can”-style entitlement, the Rinehart’s fight looks to be charity’s gain.

Greek equity markets fell sharply when they re-opened Monday, but the only Greek-equity ETF to trade on U.S. markets, the Global X FTSE Greece 20 (GREK), barely budged. It’s as if the ETF, completely in the dark thanks to the Greek equity market shut down, still managed to fairly value the underlying assets. ETF.Com posits that it proves ETFs can function as a price-discovery tool. GREK traded lower during the five-weeks the Greek equity markets were closed, and matched, more or less, the drop in the Greek market that took place Monday. “In a way, Athens is catching up to what has already happened here,” writes ETF.com’s Cinthia Murphy

Compliance Officers Held Responsible

Wall Street’s watchdog on Monday fined Aegis Capital Corp. $950,000 for sales of unregistered penny stocks and failing to implement anti-money laundering policies and procedures. The Financial Industry Regulatory Authority specifically took aim at the firm’s two chief compliance officers, who were personally fined a combined $15,000 and suspended. FINRA claims the two were directly responsible for supervising sales of the restricted securities, but failed to conduct a “meaningful inquiry” despite significant red flags. The regulator also noted that Aegis’s President and CEO, Robert Eide, was suspended for 15 days and fined $15,000 for failing to disclose more than $640,000 in outstanding liens in a separate proceeding.

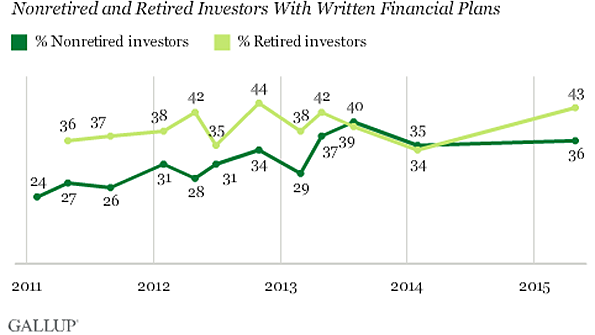

Financial Planning On The Rise

According to recent Gallup poll, the number of non-retired investors with written financial plans is up from just 24 percent in 2011 to 36 percent today. Retirees with written plans also rose, from 36 percent in 2011 to 43 percent today. The jump has coincided with the prolonged bull market in stocks and an increased confidence in the economy. Seven out of ten investors say they have a financial plan, but only 54 percent of that group say it's a written plan. Of those, three-quarters had the help of a professional financial advisor.