The big Wall Street firms are cutting back their wealth management divisions to stave off the impact of declining asset values and new fiduciary rules, reports John Aidan Byrne in The New York Post. Morgan Stanley and Bank of America’s Merrill Lynch, in particular, are eyeing ways to boost profit margins and lower expenses. No cuts are off limits, Byrne reports. The cutbacks could impact advisors’ administrative support, office space, expenses, marketing and entertainment. It could also mean cutting back office administration support. “As their Midtown captains slash costs and crack the whip for higher profits, many of Wall Street’s top go-getting brokers are near physical and mental collapse, multiple sources told The Post.”

The Most Ethical Financial Services Firms

Ethisphere Institute, a company that defines and measures corporate ethical standards, named six financial services firms to its annual list of the world’s most ethical companies. CUNA Mutual Group, Northern Trust, Prudential Financial, Thrivent Financial, TIAA and Voya Financial were judged on Ethisphere’s “Ethics Quotient,” a system it says scores companies on objective data in five different categories: ethics and compliance, corporate citizenship and responsibility, culture of ethics, governance and leadership, and innovation and reputation. Lee Augsburger, Prudential’s senior vice president and chief of ethics and compliance, said Prudential has a dedicated program to prevent, detect and resolve any potential misconduct. “When we make good character a part of how we handle our business activities, the risk of unethical corporate behavior becomes smaller for us,” Augsburger said.

Investors have lost money in the markets this year, but not enough to make them revaluate their portfolios, according to a recent survey of affluent individuals. It would take a 19 percent drop in the equities markets to cause investors to think about changing their holdings and a 22 percent decline to make them sell off their equities, according to a recent Legg Mason Global Investment Survey of 500 affluent U.S. investors. The S&P 500 ended January with a 5 percent loss and fared better in February, ending on a 0.4 percent decline. In fact, the S&P 500 has only fallen by 22 percent or more four times since 1970. “Judging by the average volatility tolerances we uncovered, investors are prepared to be patient through periods of turbulence,” said Thomas Hoops, executive vice president of Legg Mason.

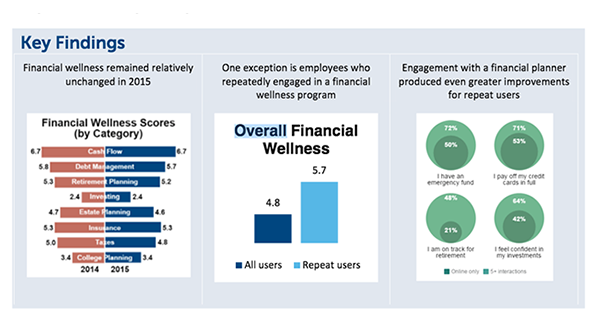

Having live interactions with a Certified Financial Planner does improve one’s fiscal wellness, according to a new report by Financial Finesse. The report studied firms that offer their employees a variety of financial advice, including live meetings with certified advisors. It found that 80 percent of employees who had five or more live interactions with a CFP have a better handle on cash flow, compared to 66 percent of online-only users. In addition, 72 percent of employees with multiple in-person meetings have an emergency fund, compared to 50 percent of online-only users. And nearly all (98 percent) of employees who interacted with CFPs contribute to their retirement plan, compared to 89 percent of those rely just on online help. Still, just 48 percent are on track with their financial planning, according to an analysis by Accounting Today.