The Information Technology sector ranks second out of the ten sectors as detailed in my Sector Rankings for ETFs and Mutual Funds report. It gets my Neutral rating, which is based on aggregation of ratings of 27 ETFs and 132 mutual funds in the Information Technology sector as of October 9th, 2013. Prior reports on the best & worst ETFs and mutual funds in every sector are here.

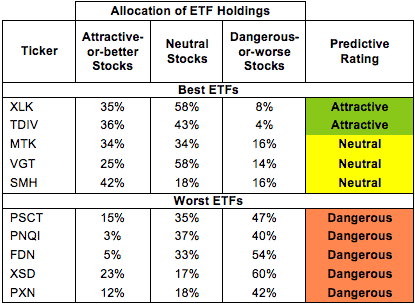

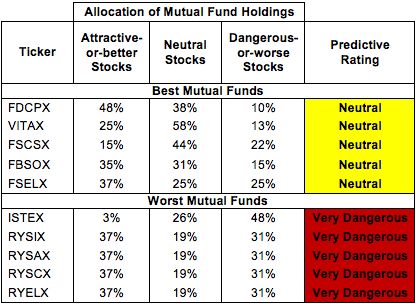

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the sector. Not all Information Technology sector ETFs and mutual funds are created the same. The number of holdings varies widely (from 25 to 417). This variation creates drastically different investment implications and, therefore, ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst ETFs and mutual funds, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the Information Technology sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expensesof each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the Information Technology sector should buy one of the Attractive-or-better rated ETFs from Figure 1.

Get my ratings on all ETFs and mutual funds in this sector on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

* Best ETFs exclude ETFs with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

* Best mutual funds exclude funds with TNAs less than $100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Six mutual funds were excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity minimums.

State Street SPDR Technology Select Sector SPDR (XLK) is my top-rated Information Technology ETF and Fidelity Select Portfolios: Computers Portfolio (FDCPX) is my top-rated Information Technology mutual fund. XLK earns my Attractive rating and FDCPX earns my Neutral rating.

PowerShares Lux Nanotech Portfolio (PXN) is my worst-rated Information Technology ETF and RS Investment Trust: RS Technology Fund (RSIFX) is my worst-rated Information Technology mutual fund. PXN earns my Dangerous rating and RSIFX earns my Very Dangerous rating.

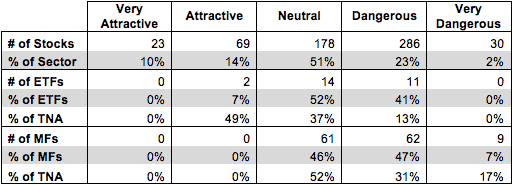

Figure 3 shows that 92 out of the 586 stocks (over 24% of the market value) in Information Technology ETFs and mutual funds get an Attractive-or-better rating. However, only two out of 27 Information Technology ETFs (49% of total net assets) and no Information Technology mutual funds get an Attractive-or-better rating.

The takeaways are: mutual fund managers allocate too much capital to low-quality stocks and Information Technology ETFs hold poor quality stocks.

Figure 3: Information Technology Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering Information Technology ETFs and mutual funds, as over 41% of ETFs and over 54% of mutual funds in the sector earn a Dangerous-or-worse rating. Only two ETFs and no Information Technology mutual funds in the Information Technology sector allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Western Digital Corp (WDC) is one of my favorite stocks held by Information Technology ETFs and mutual funds and earns my Very Attractive rating. I wrote back in June that, despite WDC’s stock price rise of 49% year-to-date, the stock was still significantly undervalued. Since then, WDC has risen by less than 1% and remains undervalued. Western Digital has increased net operating profit after taxes (NOPAT) by 27% compounded annually over the last ten years and has earned positive economic earnings for each of the past 12 years. The company has maintained a return on invested capital (ROIC) of at least 21% over the past decade, and its current ROIC of 24% places it in the top quintile of stocks that I cover. Despite the 49% year-to-date rise in stock price, WDC (~$63 /share) trades at a price-to-economic book value (PEBV) ratio of just 0.7, which means the market expects profits (NOPAT) to permanently decline by 30%. Given the company’s impressive track record of growth, the market’s expectations look too low.

Emulex Corporation (ELX) is one of my least favorite stocks held by Information Technology ETFs and mutual funds and earns my Very Dangerous rating. Emulex’s after tax profits (NOPAT) declined by 51% between 2012 and 2013. The company has realized negative economic earnings for each of the past 14 years straight. Its current return on invested capital (ROIC) of 2% places it in my lowest quintile. Such underperformance should mean that ELX would be priced relatively cheaply, but that is not the case. At its current price of ~$7.60, ELX embeds expectations for NOPAT to grow by 15% compounded annually over the next 16 years. For a company whose profits have steeply declined, the market’s expectations appear much too high. High valuation and poor quality profits mean investors should avoid this stock.

521 stocks of the 3000+ I cover are classified as Information Technology stocks, but due to style drift, Information Technology ETFs and mutual funds hold 586 stocks.

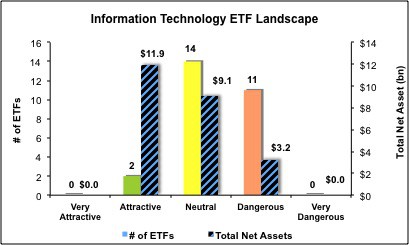

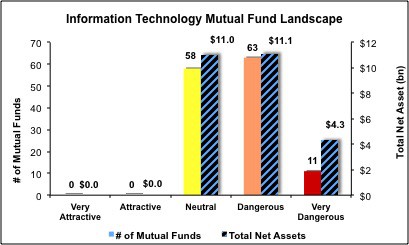

Figures 4 and 5 show the rating landscape of all Information Technology ETFs and mutual funds.

My Sector Rankings for ETFs and Mutual Funds report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Review my full list of ratings and rankings along with reports on all 27 ETFs and 132 mutual funds in the Information Technology sector.

Jared Melnyk contributed to this report.

Disclosure: David Trainer is a long WDC. David Trainer and Jared Melnyk receive no compensation to write about any specific stock, sector or theme.