The Energy sector ranks seventh out of the ten sectors as detailed in my sector roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 20 ETFs and 89 mutual funds in the Energy sector as of April 17, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog and Trading Deck.

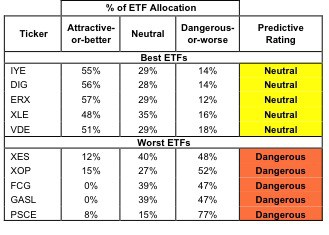

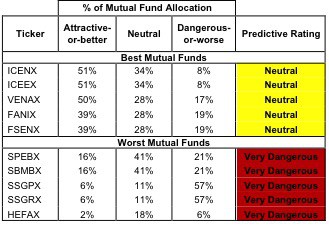

Figures 1 and 2 show the 5 best and worst-rated ETFs and mutual funds in the sector.

To identify the best and avoid the worst ETFs and mutual funds within the Energy sector, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings.

The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

Investors should not buy any Energy sector ETFs or mutual funds because none get an Attractive-or-better rating. If you must have exposure to this sector, you should buy a basket of Attractive-or-better rated stocks and avoid paying undeserved fund fees. Active management has a long history of not paying off.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with TNA’s less than 100 million for inadequate liquidity.

Sources: New Constructs, LLC and company filings

iShares Dow Jones U.S. Energy Sector Fund [s: IYE] is my top-rated Energy ETF and ICON Funds: ICON Energy Fund [s: ICENX] is my top-rated Energy mutual fund. Both earn my Neutral rating.

PowerShares S&P SmallCap Energy Portfolio [s: PSCE] is my worst-rated Energy ETF and earns my Dangerous rating. Pyxis Funds II: Pyxis Energy and Materials Fund [s: HEFAX] is my worst-rated Energy mutual fund. HEFAX earns my Very Dangerous rating because it holds 58% of its total net assets in cash and has Total Annual Costs of 4.8%, among the highest of all funds.

Figure 3 shows that 50 out of the 296 stocks (over 36% of the total net assets) held by Energy ETFs and mutual funds get an Attractive-or-better rating. However, none of the 20 ETFs and 89 mutual funds in the Energy sector get an Attractive-or-better rating.

Figure 3 shows that mutual fund managers allocate too much capital to low-quality stocks and Energy ETFs hold poor quality stocks.

Figure 3: Energy Sector Landscape For ETFs, Mutual Funds & Stocks

Sources: New Constructs, LLC and company filings

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors should not buy any Energy ETFs or mutual funds since none of them earn an Attractive-or-better rating. Instead, they should focus on individual holdings.

Exxon Mobil Corp [s: XOM] is one of my favorite stocks held by Energy ETFs and mutual funds and earns my Very Attractive rating. Exxon Mobil Corp is a well-established, consistently profitable business, with positive economic earnings in the last nine years, a feat matched by less than 10% of Russell 3000 companies. XOM’s current stock price of $84.01 implies that the company’s NOPAT (after-tax profits) will decline by 35% permanently. XOM’s consistent history of profits and low expectations for future profitability make its risk/reward appealing to investors.

Bristow Group, Inc. [s: BRS] is one of my least favorite stocks held by Energy ETFs and mutual funds. It gets my Very Dangerous rating. The company is a value destroyer. Not once, over the 14 years I’ve covered the company, has it generated a return on invested capital (ROIC) that covers its weighted average cost of capital (WACC). Despite these consistently negative economic earnings, the company has reported positive GAAP net income for all 14 of those years. Investors should avoid this stock

194 stocks of the 3000+ I cover are classified as Energy stocks, but due to style drift, Energy ETFs and mutual funds hold 296 stocks.

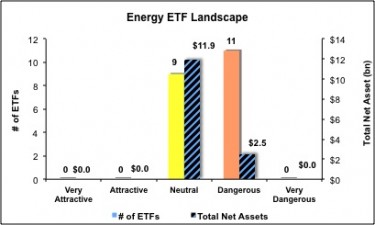

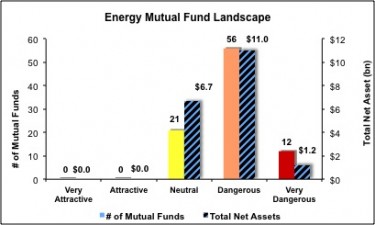

Figures 4 and 5 show the rating landscape of all Energy ETFs and mutual funds.

Our sector roadmap report ranks all sectors and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst ETFs

Sources: New Constructs, LLC and company filings

Figure 5: Separating the Best Mutual Funds From the Worst Mutual Funds

Sources: New Constructs, LLC and company filings

Review my full list of ratings and rankings along with free reports on all 20 ETFs and 89 mutual funds in the Energy sector.

Disclosure: I own XOM. I receive no compensation to write about any specific stock, sector or theme.