The all-cap growth style ranks fifth out of the twelve fund styles as detailed in my style roadmap. It earns my Neutral rating, which is based on aggregation of ratings of 2 ETFs and 436 mutual funds in the all-cap growth style as of July 18, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are here.

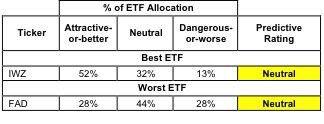

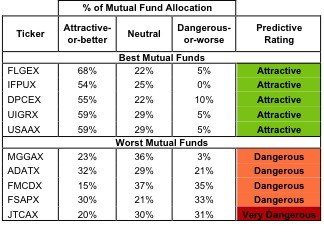

Figure 1 ranks from best to worst the two all-cap growth ETFs and Figure 2 shows the five best and worst-rated all-cap growth mutual funds. Not all all-cap growth style ETFs and mutual funds are created the same. The number of holdings varies widely (from 19 to 2042), which creates drastically different investment implications and ratings. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the all-cap growth style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the all-cap growth style should buy one of the Attractive-or-better rated mutual funds from Figures 2.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5 (where available)

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

Five mutual funds are excluded from Figure 2 because their total net assets (TNA) are below $100 million and do not meet our liquidity standards.

iShares Russell 3000 Growth Index Fund (IWZ) earns my Neutral rating and is my top-rated all-cap growth ETF. Fidelity Commonwealth Trust II: Fidelity lgCap Gro Enhanced Idx Fd (FLGEX) earns my Attractive rating and is my top-rated all-cap growth mutual fund.

First Trust Multi Cap Growth AlphaDEX Fund (FAD) earns my Neutral rating and is my worst-rated all-cap growth ETF. John Hancock Funds II: Technical Opportunities Fund (JTCAX) earns my Very Dangerous rating and is my worst-rated all-cap growth mutual fund.

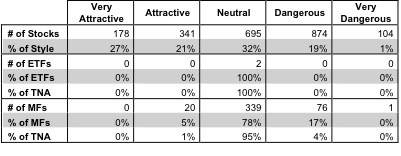

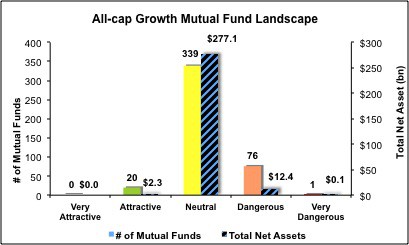

Figure 3 shows that 519 out of the 2192 stocks (over 48% of the total net assets) held by all-cap growth ETFs and mutual funds get an Attractive-or-better rating. However, no all-cap growth ETFs and only 20 out of 436 all-cap growth mutual funds (less than 1% of total net assets) get an Attractive-or-better rating.

The takeaways are: mutual fund managers pick the wrong stocks and ETFs offer exposure to poor quality stocks.

Figure 3: All-cap Growth Style Landscape For ETFs, Mutual Funds & Stocks

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

Investors need to tread carefully when considering all-cap growth ETFs and mutual funds. No ETFs and 20 mutual funds in the all-cap growth style allocate enough value to Attractive-or-better-rated stocks to earn an Attractive rating.

Exxon Mobil Corp (XOM) is one of my favorite stocks held by all-cap growth ETFs and mutual funds and earns my Very Attractive rating. Exxon is a well-established, consistently profitable business, with positive economic earnings in the last nine years, a feat matched by less than 10% of Russell 3000 companies. Exxon’s current stock price (~$85.73) implies that the company’s after-tax profits (NOPAT) will permanently decline by 40%. Consistently high historical profits and low expectations for future profitability make an attractive risk/reward tradeoff for investors.

Amylin Pharmaceuticals Inc. (AMLN) is one of my least favorite stocks held by all-cap growth ETFs and mutual funds and earns my Dangerous rating. AMLN is a value destroyer. The company has generated a negative NOPAT and economic earnings in each of the 14 years of my model and negative free cash flow (FCF) in all years but one. The company’s disappointing return on invested capital (ROIC) of -4% places it in the bottom 12th percentile of all Russell 3000 companies. AMLN is a Biotech and could develop the next cure of diabetes, which would cause the stock price to skyrocket but the company’s past performance coupled with high expectations for future profits make the stock too much of a gamble.

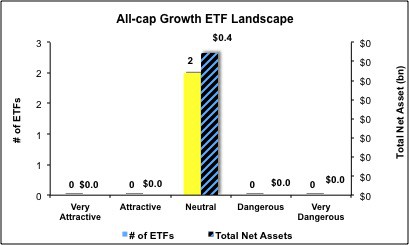

Figures 4 and 5 show the rating landscape of all all-cap growth ETFs and mutual funds.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 2 ETFs and 436 mutual funds in the all-cap growth style.

Disclosure: I own XOM. I receive no compensation to write about any specific stock, sector, style or theme.