The all-cap blend style ranks third out of the twelve fund styles as detailed in my style roadmap. It gets my Neutral rating, which is based on aggregation of ratings of 32 ETFs and 607 mutual funds in the all-cap blend style as of April 24, 2012. Reports on the best & worst ETFs and mutual funds in every sector and style are on my blog.

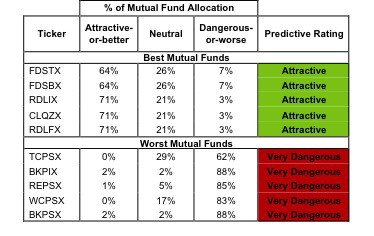

Figures 1 and 2 show the five best and worst-rated ETFs and mutual funds in the style. The best ETFs and mutual funds allocate more value to Attractive-or-better-rated stocks than the worst, which allocate too much value to Neutral-or-worse-rated stocks.

To identify the best and avoid the worst ETFs and mutual funds within the all-cap blend style, investors need a predictive rating based on (1) stocks ratings of the holdings and (2) the all-in expenses of each ETF and mutual fund. Investors need not rely on backward-looking ratings. My fund rating methodology is detailed here.

Investors seeking exposure to the all-cap blend style should buy one of the Attractive-or-better rated ETFs or mutual funds from Figures 1 and 2.

See ratings and reports on all ETFs and mutual funds in this style on my free mutual fund and ETF screener.

Figure 1: ETFs with the Best & Worst Ratings – Top 5

* Best ETFs exclude ETFs with less NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

PowerShares XTF: Dynamic OTC Portfolio [s: PWO] is excluded from Figure 1 because its total net assets (TNA) are below $100 million and do not meet our liquidity standards.

Figure 2: Mutual Funds with the Best & Worst Ratings – Top 5

* Best mutual funds exclude funds with NAV’s less than 100 million.

Sources: New Constructs, LLC and company filings

PowerShares Buyback Achievers [s: PKW] is my top-rated all-cap blend ETF and SunAmerica Focused Series, Inc: Focused Dividend Strategy Portfolio [s: FDSTX] is my top-rated all-cap blend mutual fund. Both earn my Attractive rating.

Guggenheim Wilshire 4500 Completion ETF [s: EXSP] is my worst-rated all-cap blend ETF and ProFunds: Banks ultra Sector ProFund [s: BKPSX] is my worst-rated all-cap blend mutual fund. Both earn a Dangerous-or-worse rating.

Figure 3 shows that 540 out of the 2883 stocks (47% of the total net assets) held by all-cap blend ETFs and mutual funds get an Attractive-or-better rating. To earn an attractive-or-better rating, funds must overweight attractive-or-better-rated stocks. Its obvious fund managers are failing to do this since only 4 ETFs and 17 mutual funds in the style earn an Attractive rating.

The takeaway is: mutual fund managers allocate too much capital to low-quality stocks.

Figure 3: All-cap Blend Style Landscape For ETFs, Mutual Funds & Stocks

ConocoPhillips [s: COP] is one of my favorite stocks held by all-cap blend ETFs and mutual funds and earns my Attractive rating. I’m not a fan of most Energy stocks, which is why I’m bearish on Energy sector funds, but COP is a diamond in the rough. COP’s valuation (~72.33) implies that profits will permanently decrease by 50%. With a push toward green energy, it is possible that COP will see a decrease in profits but I’m skeptical that we’ll see a 50% decrease. The upside to COP’s current valuation is profits can decrease up to 49% and the stock will beat market expectations, which will lead to price appreciation. COP offers investors great risk/reward.

Citigroup Inc. [s: C] is one of my least favorite stocks held by all-cap blend ETFs and mutual funds and earns my Very Dangerous rating. In general, I recommend investors avoid Financials stocks, ETFs, and mutual funds and Citi is a prime example why. Citi reported earnings are misleading, which means they report positive and rising accounting earnings while their economic earnings are actually negative and decreasing. This accounting window dressing is not doing Citi nor the financial industry as a whole any favors when it comes to building back the trust lost during the financial crisis. To justify its current stock price (~33.25), Citi must grow profits by 11.8% annually for 25 years. These are lofty expectation considering that Citi has seen negative profit growth in four of the past five years. I suggest investor look elsewhere if they’re seeking exposure to a Financial stock.

As detailed in “Cheap Funds Dupe Investors”, the fund industry offers many cheap funds but very few funds with high-quality stocks, or with what I call good portfolio management.

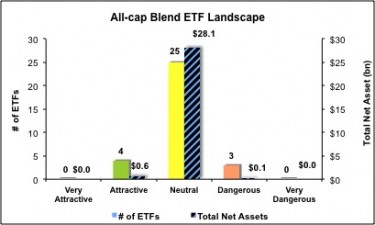

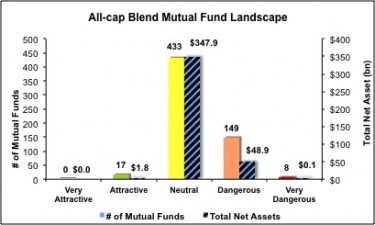

Figures 4 and 5 show the rating landscape of all all-cap blend ETFs and mutual funds.

Investors need to tread carefully when considering all-cap blend ETFs and mutual funds, as 28 of the 32 ETFs and 590 of the 607 mutual funds in the all-cap blend style are not worth buying.

Our style roadmap report ranks all styles and highlights those that offer the best investments.

Figure 4: Separating the Best ETFs From the Worst Funds

Figure 5: Separating the Best Mutual Funds From the Worst Funds

Review my full list of ratings and rankings along with free reports on all 32 ETFs and 607 mutual funds in the all-cap blend style.

Disclosure: I own COP. I receive no compensation to write about any specific stock, sector, style or theme.