While many studies signal a growing debt crisis in America, a new survey of nearly 3,000 U.S. adults indicates that Americans’ debt may not be as big a problem as you’d think. A recent GOBankingRates.com survey found that more than half of U.S. adults report having no debt, although the website says it could be because respondents overlooked certain types of debt they may have. “It’s sometimes easy to forget about a loan if it is in a deferred payment plan, like some of the retail finance offers that let people skip the first six payments,” said Bruce McClary, vice president of public relations and external affairs for the National Foundation for Credit Counseling (NFCC). “The same is true for situations where you may have a debt in your name, but someone else is managing the payments.” Of those who did say they have debt, mortgages carry the most burden; respondents had a median mortgage debt of $59,500. That was followed by student loans, with a median debt of $9,100 for respondents.

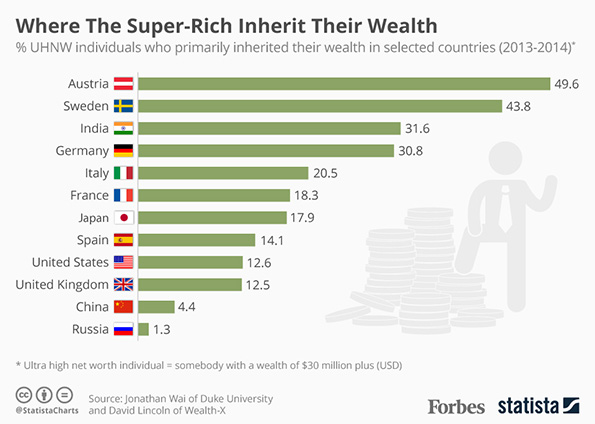

The Top Countries for Inherited Wealth

Nearly half of all ultra high net worth individuals in Austria inherited their wealth, according to a new report, Forbes details. Austria leads all countries in inherited wealth with 49.6 percent of those with $30 million or more being born into it. Next up is Sweden with 43.7 percent, followed by India, Germany and Italy. Only 12.6 percent of the uber-wealthy in the United States inherited their wealth, coming in at ninth on the list. In Russia, only 1.3 percent of the ultra-rich gained their fortune via inheritance.

Financial Confidence Among Military Families

Cuts to defense spending are considered and debated by lawmakers each year, and you would expect military families to be concerned about their own financial security in light of such legislative uncertainty. And many are. Seventy percent of career military families feel anxious about cuts to military spending, while 75 percent say they have already been affected by them, according to the First Command Financial Behaviors Index. Still, military families feel confident about their financial futures, with 52 percent expecting their situation to improve over the next year. And this confidence is especially high in military families working with a financial advisor. These families are twice as likely to say they are extremely or very confident in their ability to retire comfortably and that their financial situation will improve in the next year, compared to military families going it alone. “Our survey data continues to reveal that career military families can enjoy greater financial confidence and readiness by working with a knowledgeable professional,” said Scott Spiker, CEO of First Command Financial Services, Inc. “Taking action to feel better about family finances is particularly important in the current environment of military budget cuts."