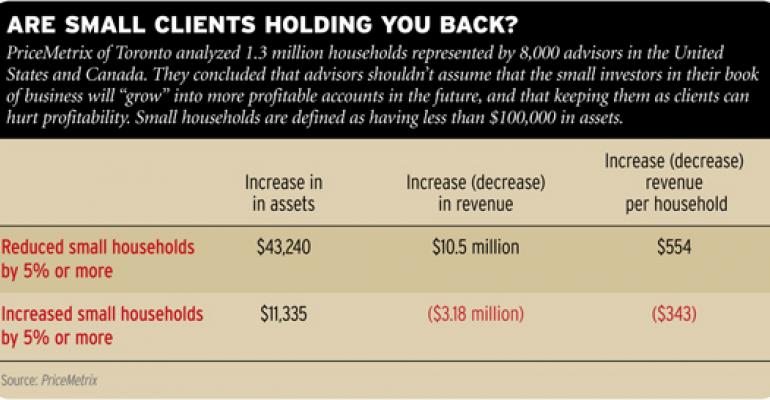

Advisors use asset allocation to get the best returns for their clients. So why don't they use the same technique to jack up their own profitability? That question was raised by PriceMetrix, a Toronto-based solutions provider for retail wealth managers. The firm's survey of 1.3 million Canadian and U.S. households served by 8,000 advisors found that small investors (less than $100,000 in assets) made up 52 percent of the advisors' accounts but produced average annual revenue of $352, barely enough to cover basic carrying costs of $12 to $30 a month. Indeed, a typical advisor with three or fewer years of experience has a book composed of 66 percent small households, 31 percent medium (assets of $100,000 to $1 million), and 3 percent large households (assets greater than $1 million). For advisors with 10 or more years of experience, the average breakdown is 51 percent, 42 percent, and 7 percent respectively. The second model boosts average revenue by 63 percent, PriceMetrix says, and nearly doubles average assets.