By Klaus Wille

(Bloomberg) --The $1.45 billion Quantedge Global Fund gained 21 percent this year, ranking it as the top performer in its category as similar strategies have posted losses.

The fund, which uses quantitative models to bet on global macro themes, added 6.8 percent in July, helped by bets on commodities, equities and currencies, according to a newsletter obtained by Bloomberg News, which didn’t elaborate on specific trades. The performance makes the Singapore-based fund the best-performing in the world this year among quant rivals with more than $1 billion in assets, according to data provider Eurekahedge Pte.

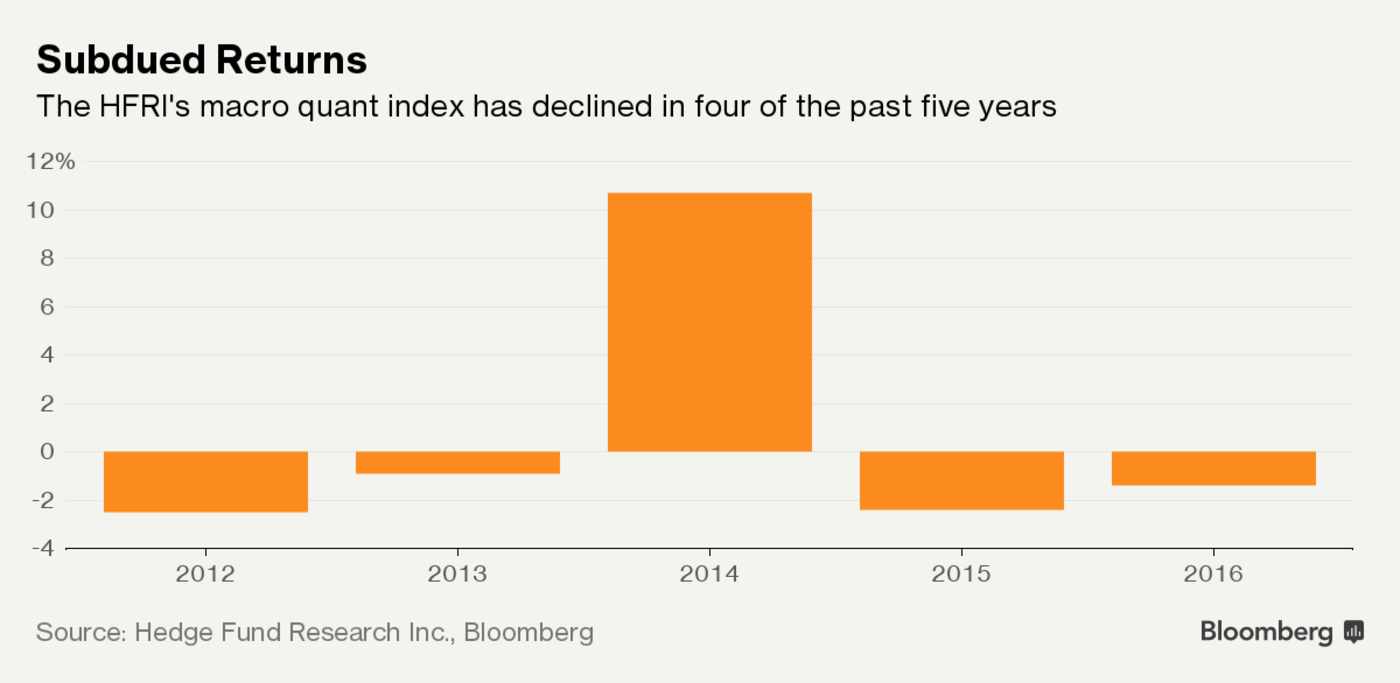

Quantedge’s returns stand out as macro managers worldwide are grappling with the impact of years of central bank intervention, conflicting economic signals and muted returns. The fund’s year-to-date return through July compares with a 1.5 percent decline in the HFRI Macro Systematic Diversified Index, which tracks similar strategies. The losses so far in 2017 would put the gauge on track for its third straight year of declines.

Most major asset classes advanced in July, with the MSCI World Index adding 2.3 percent and the Bloomberg Commodity Index rising 2.2 percent, the best monthly gain since September. The Bloomberg Barclays Global-Aggregate Total Return Index, a measure of global bond performance, advanced 1.7 percent last month, the most in more than a year.

A spokeswoman for Singapore-based Quantedge declined to comment.

The quant macro fund’s gains this year add to a 27 percent gain in 2016, according to the newsletter. The fund has gained a cumulative 995 percent since its inception in October 2006, for an annualized return of 25 percent. Quantedge Global Fund was founded by former reinsurance pricing actuary Leow Kah Shin and Chua Choong Tze, who had previously taught a course in portfolio management at Singapore Management University.

The fund added five employees as the breadth of its trades has grown, bringing the headcount to 43 in its two offices in Singapore and New York, it said in the newsletter. The new additions comprise four operations analysts and a software developer.

To contact the reporter on this story: Klaus Wille in Singapore at [email protected] To contact the editors responsible for this story: Sree Vidya Bhaktavatsalam at [email protected] Paul Panckhurst