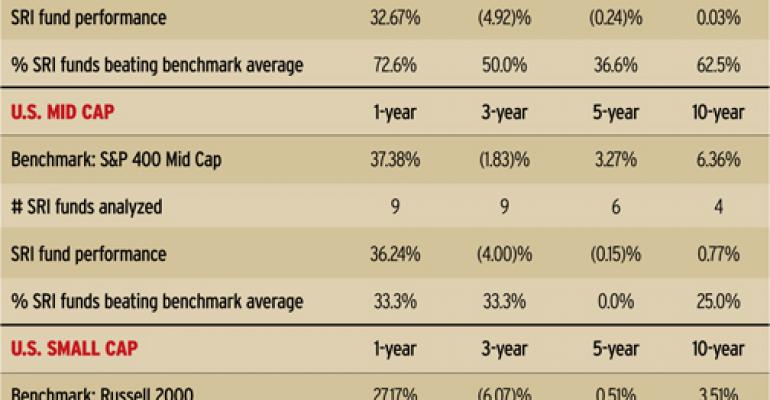

A review of 160 socially responsible mutual funds from 22 Social Investment Forum (SIF) member fund families shows that the majority of the funds outperformed the benchmarks for their categories in calendar year 2009. In particular, nearly three out of four (72.6 percent) of the 73 U.S. large cap SRI funds that are SIF members outperformed the S&P 500 by an average of more than six percentage points. In addition, U.S. small cap, U.S. balanced, international equity-global funds and U.S. fixed income bonds also topped their respective benchmarks. David Kathman, a mutual fund analyst with Morningstar, says this may be in part because they held more technology stocks and fewer industrial stocks than the general market in 2009. Technology stocks tend to fit the socially responsible stock screens, he says.