Brad Zigler (BZ): You're the man behind the GreenHaven Continuous Commodity Index ETF (NYSE Arca:GCC). Elaborate, if you will, on the index underlying GCC. What's its significance?

Ashmead Pringle (AP):It’s a team effort, to be sure. The index we chose is the Thompson Reuters Continuous Commodity Index, or CCI, which was known as the CRB (Commodity Research Bureau) Index until 2005 when it was renamed. While the name changed, the index composition did not, so the CCI traces its history back to the origin of the CRB in 1957. That makes CCI the longest-running major commodity futures benchmark. Though it’s been revised periodically to reflect market evolution, it’s always been an equally weighted index. The current makeup includes 17 commodities, representing metals, energy, agriculture and soft commodities.

The value of each commodity in the CCI is not based solely on the front (spot) month futures, but on the average of contracts across the nearest six delivery months. Other indexes in the space began as front-month-only benchmarks but later moved further out on the curve. These were then touted as “second generation” indexes. I think it’s worth noting that the CCI was born as a second generation index.

Besides being an equal weight index, the CCI rebalances daily. This maintains the equal weighting and prevents the allocations from drifting over time.

BZ:Your fund was voted the best broad market commodity ETP for 2012 by Morningstar. What's the advantage to an advisor or investor using GCC versus another commodity index product? Versus an actively traded product?

AP:Lower volatility, for one thing. The low energy weight (18%) of the CCI means less concentration in that volatile sector, while other indexes allocate up to 65% to energy. Plus, the lower energy weight allows a higher weight in the ag (agricultural) sector which should benefit from long term trends in rising global population and GDP. Another reason is performance. Since we launched in 2008, the CCI has outperformed most of its competitor indexes.

As to managed products, they’re fundamentally different from an index fund, just as an S&P index fund is a fundamentally different strategy from a hedge fund. A commodity index fund is designed to deliver long-only unleveraged broad exposure to commodities while the managed futures product is probably leveraged and long/short. The choice depends on the investor’s goals.

BZ:Why is an equal-weighted product better?

AP:When equal weighting is done across a broad basket of commodities, as in the CCI, the result is exposure to the broad commodity market, not to just a part of it. With the resultant lower exposure to energy, volatility tends to be lower. If you will, diversification within a commodity allocation can improve the risk/return ratio, just as it can across an entire investment portfolio.

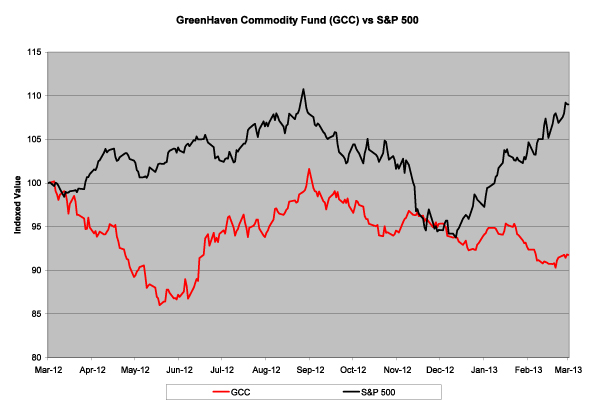

BZ:Commodities, as a rule, are generally thought to be negatively correlated to stocks. Over the past five years, however, the correlation of CCI and the S&P 500 has been positive. It's negative against long-term government bonds, though. Is that significant? In other words, is GCC more beneficial, from a diversification perspective, for older, more risk-averse investors?

AP:I think commodities can provide diversification to any portfolio of fixed income and equities, not just for seniors like me. Besides, I’m bearish on bonds.

It’s true that over the last five years commodities would have had a more diversifying effect on a bond portfolio than on an equity portfolio, but the last five years have been atypical, to say the least. Bonds have been in a bull market since 1983, and with yields at historic lows it’s hard to see more upside. As a former Fed chairman once said, the Fed’s job is to spike the punch bowl and then to take it away when the party gets going. By depressing short-term rates to near zero, the Fed has subsidized the banks and corporate earnings. At some point it has to take away the punch bowl by removing excess liquidity and allowing rates to rise.

Going forward, I expect the commodities-equities correlation to trend back to more historical levels.

BZ:You've been a hedger for years, specializing in agricultural commodities. Step out of that role for a moment and become a financial advisor. Why would an investor be inclined to utilize commodities as a portfolio allocation?

AP:There are three major reasons to allocate to commodities. First, they have historically had a low correlation to equities and fixed income while providing an equity-like return. That’s the diversification argument. Second, commodities tend to rise during inflationary periods and can therefore be a hedge against inflation. Third, industrialization increases commodity demand so commodities can provide exposure to emerging markets like China, India and developing Asia.

BZ:What should advisors/investors know about a commodity investment? How is it different from buying equity or fixed income exposure?

AP:The big questions are “is it leveraged or unleveraged, is it long-only or is it long and short, is it physical ownership or futures contracts, is it concentrated in one commodity, one sector or across a broad basket of commodities? “ Exchange-traded products (ETPs) trade just like listed common stocks do, so the transactions to buy or sell are the same.

BZ:Here's the $64,000 question: What's in store for commodities now? Any fearless prognostications?

AP:In real terms, commodities haven’t returned to the highs we saw in the 1950s and the 1980s so they’re not historically high, but about average. Though the short term global economic picture is clouded by sequestration in the U.S., a continuing and wrong-headed European emphasis on austerity, and questions about China’s growth, the long term picture is clearer. Over the next 15-20 years, global population will grow by 2 billion to 9 billion and many of them will move up into an expanding middle class. As they do, they will demand more housing, transportation, better diets, and consumer goods.

BZ:Last, your firm has focused on a single fund since its 2008 inception. Any thoughts about bringing out another product? What seems interesting to you?

AP:We do have another fund in the pipeline, but because it’s still in registration I can’t talk about it. I can say that it aims to track a single commodity that’s globally important, but which, so far, is not tracked by any exchange-traded products. Stay tuned! [Editor’s Note: While Mr. Pringle can’t talk about the fund in registration, we can. It’s the GreenHaven Coal Index Fund]