New York, NY/ August 1, 2013 - Financial advisors overall are increasingly optimistic about the economy and the stock market, but their view is tempered somewhat by those who perceive a dark cloud looming further out into the future.

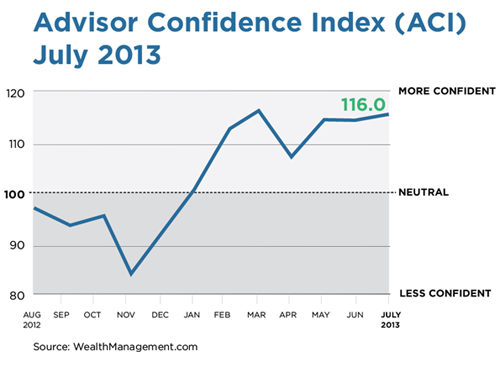

The WealthManagement.com Advisor Confidence Index (ACI), a benchmark of financial advisors’ views on both the current and future states of the U.S. economy and the stock market, rose 1.7% in July to 116.02, matching the level of optimism advisors felt in March. WealthManagement.com is a division of Penton.

That boost in optimism was fueled by a 3% increase in advisors’ favorable impression of the current state of the economy. When asked how the economy would look in six months time, advisors confidence level remained unchanged from the previous month.

But when asked their views on the economy in 12 months time, the confidence level, while remaining in positive territory, fell 3%.

“It'd be close to a miracle if we don't go into a recession by the end of the year or the beginning of next year,” noted one particularly pessimistic advisor, Bjorn Tuypens of Platinum Grove Asset Management in Purchase, N.Y. “The sequester will hit the U.S. economy hard in the third quarter. In addition, the combined 150 basis point rise in mortgage rates and rise in energy prices will hit the consumer hard.”

Most advisors feel that a disconnect between the economy and the stock market persists, with most registering a dramatically better view of the market’s prospects. The benchmark asking advisors for their level of optimism in the markets over the next six months increased by 5% in July, though many still attribute the stock market ascendance to federal fiscal stimulus programs, and not necessarily to ongoing improvement in the economy or corporate earnings.

“With inflation on the horizon and higher interest rates, the stock market is positioned to continue its climb. This will not be without fits and declines, but inflation always increases the market value,” said Guy Baker of Wealth Team Solutions in Irvine, Calif.

Still, many advisors counsel caution. “Uncertainty is the order of the day. We are caught between deflation and the possibility of reflation. Positive growth would increase market valuations and PE (price to earnings) multiples, but over shooting and high inflation may be on the horizon. The very tentative nature of the current environment could cause a great deal of volatility,” added Roger Willroth of Marrs Wealth Management.

Not all agree that the fed’s stimulus programs are pumping hot air into the market. Jonathan Foster, president and CEO of Angeles Wealth Management, agrees. “With Bernanke's ‘Taper Talk’, the market heard ‘Sell Bonds’, but I heard ‘Buy Stocks.’ The Fed will taper because they see signs of sustainable economic progress. They see all the cards, so we should bet with their hand.”

Key Stats:

| Current state of the economy: 3% |

| Economy in six months: 0% |

| Economy in twelve months: -3.5% |

| Markets in six months: 4.9% |

WealthManagment.com’s ACI records the views of a panel of some 150 financial advisors who agreed to participate on a monthly basis, recording their level of confidence across four categories: confidence in the current state of the economy, confidence in the economy in both six months and 12 months, and confidence in the near-term future of the stock market.

About Advisor Confidence Index’s Methodology

The Advisor Confidence Index is a benchmark that gauges advisors’ views on the economy. The ACI captures the views of a panel of 130 financial advisors, all of who agreed to respond to the survey. The survey asks four questions – an advisor’s view on the economy, the economy in six months, the economy in twelve months and the stock market – on a scale from most pessimistic to most optimistic. The cumulative average is calculated for each question and then added for the overall benchmark.

About WealthManagement.com

As the digital resource of REP. and Trusts & Estates, WealthManagement.com provides everything wealth professionals need to know to stay knowledgeable about the industry, build stronger relationships, improve their practice, and grow their business—all from one site. It boasts more than 60 editorial contributors who provide content for the more than 645,000 members of our wealth management community.

About Penton

For millions of business owners and decision-makers, Penton makes the difference every day. We engage our professional users by providing actionable ideas and insights, data and workflow tools, community and networking, both in person and virtually, all with deep relevance to their specific industries. We then activate this engagement by connecting users with tens of thousands of targeted providers of products and services to help drive business growth. Learn more about our company at www.penton.com/.

Penton is a privately held company owned by MidOcean Partners and U.S. Equity Partners II, an investment fund sponsored by Wasserstein & Co., LP.

###

Contact for WealthManagement.com:

David Armstrong

Editor-in-Chief

WealthManagement.com

Phone: (212) 204-4398

Email: [email protected]

Contact for Penton:

Kate Spellman

SVP, Marketing

Penton

Phone: (212) 204-4351

Email: [email protected]