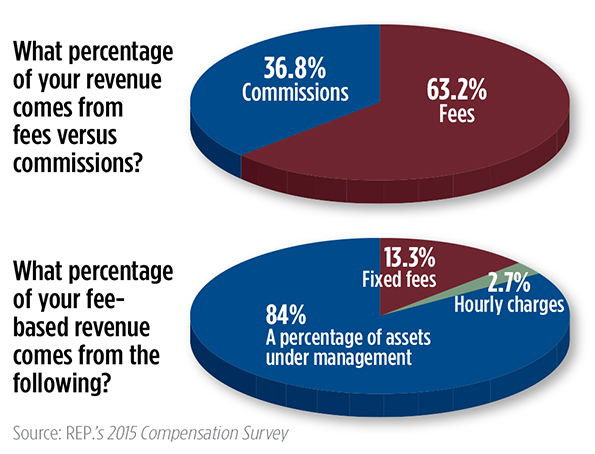

The industry has come a long way in embracing a fee-based business. Five years ago, fees accounted for less than half of all advisors’ revenue. But advisors derived about 63 percent of their revenue from fee-based assets. And we can expect that trend to continue. “If you’re going to do only a commission-based business, you’re going to fall by the wayside,” says Dan Inveen, principal and director of research at FA Insight.

Last year, a majority of advisors said they charged fees using a percentage of clients’ assets under management, expect that to also evolve, Matt Lynch, founder of Ohio-based consulting firm Strategy & Resources. “Watch fixed fees grow and a movement away from AUM based pricing,” he says. While it’s a bit too early to see the trend now, over the next few years the usage of fixed fees will increase substantially.

What Do You Charge?

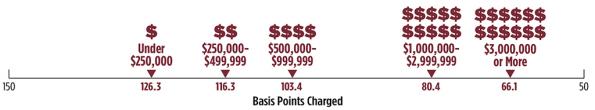

About 84 percent of advisors' fee-based revenue comes from a percentage of clients' assets under management. But what advisors charge can range dramatically. Here's the asset management fee, on average, charged to clients who fall into each portfolio range.

Perhaps unsurprisingly, when examined by channel, wirehouse advisors generally charged clients the most on fee-based assets, particularly with smaller clients. But as Lynch points out, the important data point is that most of the answers are wrong. “No one really incorporates total cost to the client. This is just the direct fee. Do reps even know, in total, what their clients pay?” he says.

To Serve Man

Across all channels, advisors grew their clients by about 8 percent over the past year.

But breaking out the data by channel, pure RIA advisors (those not affiliated with a broker/dealer) actually grew their client base the most, up 10 percent over the past year.

Meanwhile bank brokers barely grew the number of clients they serve, up only 3 percent on average.

Next: Breaking Down the Practice