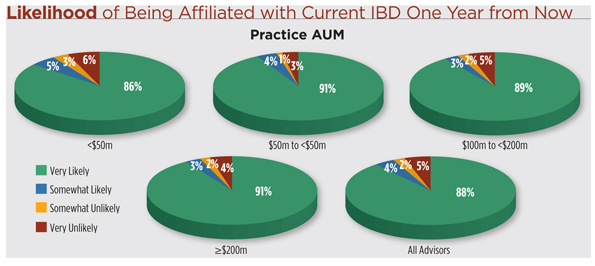

The majority of advisors participating in REP.’s 2014 Independent Broker/Dealer Report Card indicated that they are likely to remain affiliated with their current IBD during the next year. This is excellent news for independent broker/dealers, especially since 88 percent of the advisors reported that they are very likely to stay in place. But sliced another way, this data also reveals that 7 percent of advisors are likely to make a change within the upcoming year. This underlying group of defecting advisors rated their IBDs with a D average at only 6.0 points out of 10—much lower than the 9.1 points given by the other participants. And that percentage of likely defectors holds steady across all practice sizes. The IBD Report Card reveals important triggers that cause advisors to leave their firms. This is lucrative information for firms; it not only provides valuable insight to help stave off advisor attrition, but it also highlights opportunities to remedy sore spots and enhance recruiting efforts.

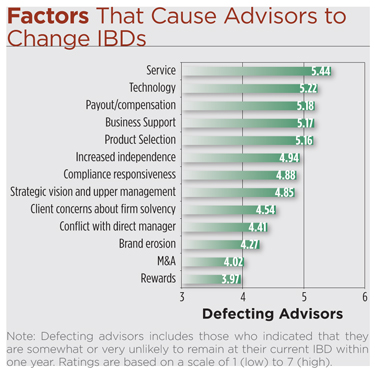

What causes the most pain for defecting advisors? They unanimously pointed to poor service as the most important factor influencing their decision to leave. And the poor service ratings are consistently low across all AUM ranges. Advisors want to rely on the  quality, speed, tone and ease of service from their broker/dealers. Even one service slip can jeopardize the goodwill generated by many positive experiences—especially when a mishap causes an advisor to look bad with his or her client. Service breakdowns can easily occur when a task passes across functional departments, and it can be especially challenging for an advisor when he or she is forced to call around to multiple departments to get things done. To make service really shine, IBD staff must have a deep understanding of the needs and context of the advisors and their practices, but this is difficult to achieve with a large staff with deep and varying functional expertise.

quality, speed, tone and ease of service from their broker/dealers. Even one service slip can jeopardize the goodwill generated by many positive experiences—especially when a mishap causes an advisor to look bad with his or her client. Service breakdowns can easily occur when a task passes across functional departments, and it can be especially challenging for an advisor when he or she is forced to call around to multiple departments to get things done. To make service really shine, IBD staff must have a deep understanding of the needs and context of the advisors and their practices, but this is difficult to achieve with a large staff with deep and varying functional expertise.

Cultural Differences

Culture heavily influences the “look and feel”of a firm’s service orientation. Among management categories, defecting advisors ranked their firm’s culture the lowest. Many advisors have indicated to Cerulli through both interviews and surveys that their broker/dealer’s culture has declined as the firm has grown, dampening service levels and reducing advisor centricity. While no company can dictate a desired culture, they can influence it. This means making tough tradeoffs, sticking relentlessly to the desired strategy, and communicating with unwavering consistency.

Raymond James Financial Services, Commonwealth Financial Network and Cambridge Investment Research are all culture-centric IBDs and have successfully used their strategy as a point of differentiation. Overall, their advisors scored them well above average in regards to their culture. Raymond James Financial Services is an example of a large IBD that has been able to maintain its culture as it has grown. They have emphasized recruiting larger and more productive advisors instead of a large quantity of advisors. They are careful to recognize that not all advisors are a mutually good fit, and the results are reflected in their high average AUM-per-advisor. By being discerning in their recruiting process, they are able to retain a sense of community.

The Technology Factor

Only 30 percent of advisors who transitioned to their current IBD within the past three years indicated that technology was a factor in their decision, yet it ranked as the second most important factor for those who are likely to defect in the coming year. In other words, technology has become a more important motivation for switching firms. Across the board, these advisors gave their IBDs’ technology a failing grade of 5.7 out of 10.

They are least satisfied with their ability to personalize technology solutions to meet their specific needs. The challenge for IBDs is that many advisors also struggle to adopt new technologies, stay ahead of rollouts and fully use existing technologies. Given this context, IBDs must strike a careful balance between providing easy-to-adopt, turnkey tools and more complicated, customizable solutions.

Defecting advisors are also unhappy with the integration of technology systems, which is a critical element to decrease their administrative burden and maximize service quality to their clients. They also rated multiple technology tools lower than 6.0, including online investor tools, financial planning software, mobile applications, performance reporting and CRM systems.

Practice Support and Professional Development

Defecting advisors also gave their current IBDs a failing grade for practice support and professional development (5.7 out of 10). They rated their IBDs below 6.0 out of 10 for numerous offerings, including sales coaching, succession planning support, peer networking opportunities, practice management support, marketing services, financial planning experts and product selection experts.

There are many advantages for IBDs to provide robust offerings, and the reasons stem beyond advisor retention. Practice management, for example, not only strengthens relationships with advisors through high-impact interactions, but it also develops a more productive field force. The quality of practice management offerings varies widely across independent broker/dealers. One-on-one or group consulting and coaching programs generally yield the best results, but it is difficult to scale these offerings, and some aren’t willing to assume the cost. Some instead offer watered-down self-help resources, but these yield less impact on advisor satisfaction.

Another example is sales coaching. Even as the industry evolves away from a product sales orientation, business development remains a core competency for successful advisors. This is a critical offering for both junior advisors who enter the business as well as established advisors who want to grow their top line. Established advisors don’t need to relearn the basics. They do, however, struggle to balance the day-to-day responsibilities of running their business while simultaneously finding enough time and energy to focus on revenue-generating activities. A coach can help these advisors stay focused on revenue-generating activities in the face of distractions.

Why Large Advisors Switch

The study shed further light on triggers for large practices. Those with $100 million or more in assets indicated that the strategic vision of their IBD and its upper management is one of the most critical factors in their decision to change firms.

Interestingly, they did not rank increased independence among the most important factors. This may be the result of large IBDs more commonly offering multiple affiliation options in response to the threat of advisor defections to RIAs, which is especially appealing to their largest advisors. This offers these advisors more flexibility in structuring their relationship with the IBD. Given that the hybrid space was the largest net winner of market share among all channels in 2013, the IBDs that retain and attract these assets will be well positioned for growth.

The survey revealed pain points that could cause advisors to change firms, but the final say should come from each individual advisor. It is common for the staff in a practice to have more interaction with a firm’s home office than the advisors themselves, so advisors can become disconnected from the home office. Firms need to provide one-on-one attention to each advisor relationship. As headcount expands, it is easy to lose sight of an individual’s needs and concerns. Nurturing the relationship allows the broker/dealer to take a temperature check and determine whether a particular advisor is at risk of departing and why.

Kenton Shirk is responsible for the intermediary practice at Cerulli Associates and contributes to the Intermediary Distribution, Advisor Metrics and State of the RIA Marketplace reports. He has more than 15 years of experience in the financial services industry.